ATM is an electronic tool that serves bank customers to take money and check their savings accounts without the need to be served by a human teller. Many ATMs also serve cash storage or checks, money transfers or even buy cell phone credit.

ATMs are often placed in strategic locations, such as restaurants, shopping malls, airports, railway stations, bus terminals, supermarkets and banks' of

An NCR ATM machine, multi-function ATM in the United States

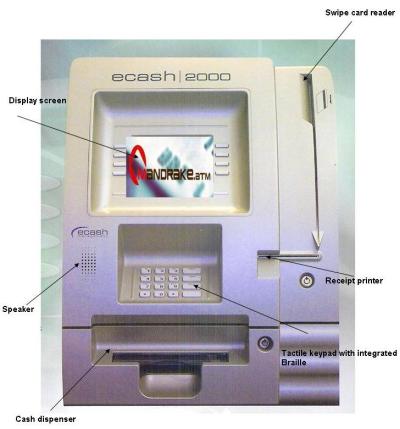

An NCR ATM machine, multi-function ATM in the United States HardwareThe component diagram of an ATM machineATMs typically consist of the following devices:

CPU (to control user interface and transaction device)

Magnetic reader and / or card chip (to identify customer)

PIN keyboards (similar to the layout of keyboards of touch pads or calculators), often produced as part of the storage frame.

Security Cryptopor processor, generally in a safe frame section.

Monitor (used by customers to make transactions)

Function keys (usually close to the screen) or touch screen (used to select various aspects of a transaction)

Recording machine (to provide customers with their transaction records)

Storage space (for storing machine parts that require limited access)

Housing (for aesthetics and to attach a signature)Due to heavier computing demands and falling prices for machine architecture such as the Personal Computer, ATMs have switched from custom hardware architectures using microcontrollers and / or application-specific integrated circuits to adopt the hardware architecture of a Personal Computer, such as, a USB connection for peripherals , Ethernet and IP communications, and using a personal computer operating system. While it is undoubtedly cheaper to use commercial hardware "outside the shell", this makes ATMs potentially vulnerable to the same types of problems demonstrated by conventional Personal Computer.

The component diagram of an ATM machine

The component diagram of an ATM machine SoftwareA Wincor Nixdorf ATM machine runs Windows 2000.By migrating to the commodity hardware of Personal Computer, commercial standard operating systems are "out of the shell", and the programming environment can be used inside the ATM. Typical platforms previously used in ATM development include RMX or OS / 2.Currently, most ATMs worldwide use the Microsoft Windows operating system, especially Windows XP Professional or Windows XP Embedded. [18] A small amount of deployment can still run Windows OS versions like Windows NT, Windows CE, or Windows 2000.There is also a computer security industry that holds that the desktop operating system of the general public has a greater risk as an operating system for money dispensing machines than other types of operating systems such as (safe) Real-time operating system (RTOS).Linux also found some acceptance in the ATM market. An example of this is Banrisul, the largest bank in southern Brazil, who replaced the MS-DOS operating system at its ATM with Linux. Banco do Brasil also migrates its ATMs to Linux.With the occurrence of Windows and XFS operating systems at ATMs, software applications have the ability to be smarter. This has created a new generation of ATM applications commonly referred to as dwiprogram applications. This type of application allows an entirely new host to apply where an ATM terminal can do more than just communicate with an ATM switch. Currently being empowered to connect to other content servers and banking video systems.

The leading ATM software that operates on the XFS platform includes

Triton PRISM, Diebold Agilis EmPower, NCR APTRA Edge, AbsoluteINTERACT

Absolute Systems, Kalignite KAL, Phoenix Interactive VISTAatm, and

Wincor Nixdorf ProTopas.UseKeyboard ATM machines in Germany.At

most modern ATMs, customers are identified by inserting plastic ATM

cards with magnetic strips or plastic smart cards with chips, containing

unique numbered cards and some security information such as expiration

date or Card security code (CVV). This authentication is provided by the customer when entering a personal identification number (PIN). The latest ATMs at Royal Bank of Scotland operate without a card to withdraw cash up to £ 100. Customers must initially register their mobile phone number and the

bank will provide a six-digit code to enter the ATM to withdraw the

cash.Using

ATMs, customers can access their bank accounts to make withdrawals,

cash through debit cards, and check their account balances and purchase

prepaid cell phone credits. If

the currency withdrawn from an ATM differs from a bank account in the

currency (for example: Withdrawal of Japanese Yen from a bank account

containing US Dollars), the money will be converted to its current

currency at the exchange rate. Thus, ATMs can be used for money exchange transactions for foreign tourists.

The leading ATM software that operates on the XFS platform includes

Triton PRISM, Diebold Agilis EmPower, NCR APTRA Edge, AbsoluteINTERACT

Absolute Systems, Kalignite KAL, Phoenix Interactive VISTAatm, and

Wincor Nixdorf ProTopas.UseKeyboard ATM machines in Germany.At

most modern ATMs, customers are identified by inserting plastic ATM

cards with magnetic strips or plastic smart cards with chips, containing

unique numbered cards and some security information such as expiration

date or Card security code (CVV). This authentication is provided by the customer when entering a personal identification number (PIN). The latest ATMs at Royal Bank of Scotland operate without a card to withdraw cash up to £ 100. Customers must initially register their mobile phone number and the

bank will provide a six-digit code to enter the ATM to withdraw the

cash.Using

ATMs, customers can access their bank accounts to make withdrawals,

cash through debit cards, and check their account balances and purchase

prepaid cell phone credits. If

the currency withdrawn from an ATM differs from a bank account in the

currency (for example: Withdrawal of Japanese Yen from a bank account

containing US Dollars), the money will be converted to its current

currency at the exchange rate. Thus, ATMs can be used for money exchange transactions for foreign tourists.  Keyboard ATM machines in Germany.

Keyboard ATM machines in Germany. UseKeyboard ATM machines in Germany.At most modern ATMs, customers are identified by inserting plastic ATM cards with magnetic strips or plastic smart cards with chips, containing unique numbered cards and some security information such as expiration date or Card security code (CVV). This authentication is provided by the customer when entering a personal identification number (PIN). The latest ATMs at Royal Bank of Scotland operate without a card to withdraw cash up to £ 100. Customers must initially register their mobile number and the bank will provide a six-digit code to enter the ATM to withdraw the cash. Using ATMs, customers can access their bank accounts to make withdrawals, cash through debit cards, and check their account balances and purchase prepaid cell phone credits. If the currency withdrawn from an ATM differs from a bank account in the currency (for example: Withdrawal of Japanese Yen from a bank account containing US Dollars), the money will be converted to its current currency at the exchange rate. Thus, ATMs can be utilized for foreign exchange transactions for foreign travelers. Alternative useATM machine with various functions in South Korea.Gold ATM machine in New York City.Although ATMs were originally developed merely as a place to take cash, these tools have evolved to include many other related banking products such as:

Printing a checking account

Printing a checking accountUpdating the savings book

Paying regular bills:

Household bills (cable, PAM, telephone and electricity)

School / university bills

Insurance

Tax

Getting a fast loan

Processing checks

Pay (in full / in part) the balance on the credit card associated with a particular account.

Transferring money between related accounts (such as transfers between savings accounts), either from one bank or two different banks that are related to each other, if available.

Recognition of deposits, receipts, and circulation of money. In some countries, particularly those that utilize integrated cross-bank ATM networks. ATMs include many functions that are not directly related to the management of bank accounts themselves, such as:

Load money value into Prepaid Card

Buy:

Stamps

Lottery ticket

Transportation ticket (train, plane, etc.)

Concert tickets

Cinema tickets

Mobile phone credit

Gold

Game and promotional features

Donate to a charity

Gold ATM machine in New York City

Gold ATM machine in New York City X . I

How ATMs Work?

Introduction:

The automatic teller machine (ATM) is an

automatic banking machine (ABM) which allows customer to complete basic

transactions without any help of bank representatives. There are two

types of automatic teller machines (ATMs). The basic one allows the

customer to only draw cash and receive a report of the account balance.

Another one is a more complex machine which accepts the deposit,

provides credit card payment facilities and reports account information.

It is an electronic device which is used

by only bank customers to process account transactions. The users

access their account through special type of plastic card that is

encoded with user information on a magnetic strip. The strip contains an

identification code that is transmitted to the bank’s central computer

by modem. The users insert the card into ATMs to access the account and

process their account transactions. The automatic teller machine was

invented by john shepherd-Barron in year of 1960.

Automatic Telling Machine Block Diagram:

The Automatic telling machine consists of mainly two input devices and four output devices that are;Input Devices:

- Card reader

- Keypad

- Speaker

- Display Screen

- Receipt Printer

- Cash Depositor

- Card Reader:

The card reader is an input device that

reads data from a card .The card reader is part of the identification of

your particular account number and the magnetic strip on the back side

of the ATM card is used for connection with the card reader. The card is

swiped or pressed on the card reader which captures your account

information i.e. the data from the card is passed on the host processor

(server). The host processor thus uses this data to get the information

from the card holders.

- Keypad:

The card is recognized after the machine

asks further details like your personal identification number,

withdrawal and your balance enquiry Each card has a unique PIN number so

that there is little chance for some else to withdraw money from your

account. There are separate laws to protect the PIN code while sending

it to host processor. The PIN number is mostly sent in encrypted from.

The key board contains 48 keys and is interfaced to the processor.

- Speaker:

- Display Screen:

- Receipt Printer:

The receipt printer print all the

details recording your withdrawal, date and time and the amount of

withdrawn and also shows balance of your account in the receipt.

- Cash Dispenser:

The cash dispenser is a heart of the ATM. This is a central system

of the ATM machine from where the required money is obtained. From this

portion the user can collect the money. The duty of the cash dispenser

is to count each bill and give the required amount. If in some cases the

money is folded, it will be moved another section and becomes the

reject bit. All these actions are carried out by high precision sensors.

A complete record of each transaction is kept by the ATM machine with

help of an RTC device.

ATM Networking:

The internet service provider (ISP) also

plays an important role in the ATMs. This provides communication

between ATM and host processors. When the transaction is made, the

details are input by the card holder. This information is passed on to

the host processor by the ATM machine. The host processor checks these

details with authorized bank. If the details are matched, the host

processor sends the approval code to the ATM machine so that the cash

can be transferred.

2 Types of ATM Machines

Most of the host processors can support either leased line or dial up machines- Leased line ATM machines

- Dial up ATM machines

The leased line machines connect direct

to the host processor through a four wire point to point dedicated

telephone line. These types of machines are preferred in place. The

operating cost of these machines is very high.

Dial Up ATM Machines:

The dial up ATMs connects to the host

processor through a normal phone line using a modem. These require a

normal connections their and their initial installation cost is very

less. The operating cost of these machines is low compared with leased

line machines.

ATM Security:

The ATM card is secured with PIN number

which is kept secret. There is no way to get the PIN number from your

card. It is encrypted by the strong software like Triple data Encryption

Slandered.

Automatic Teller Machine Working Principle:

The Automatic teller machine is simply a

data terminal with two input and four output devices. These devices are

interfaced to the processor. The processor is heart of the ATM machine.

All the ATM machines working around the world are based on centralized database system.

The ATM has to connect and communicate with the host processor

(server). The host processor is communicating with the internet service

provider (ISP). It is the gateway through all the ATM networks

available to the card holder.

When a card holder wants does an ATM

transaction, user provides necessary information through card reader and

keypad. The ATM forwards this information to the host processor. The

host processor enters the transaction request to the cardholder bank. If

the card holder requests the cash, the host processor takes the cash

from the card holder account. Once the funds are transferred from the

customer account to host processor bank account, the processor sends

approval code to the ATM and the authorized machine to dispense the

cash. This is the way to get the amount on ATMs. The ATM network is

fully based on centralized database environment. This will make life

easer and secured the cash.

Advantages of Automatic Teller Machine:

- The ATM provides 24 hours service

- The ATM provides privacy in banking communications

- The ATMs reduce the work load banks staff

- The ATM may give customer new currency notes

- The ATMs are convenient to banks customers

- The ATM is very beneficial for travelers

- The ATM provide services without any error

Features of Automatic Teller Machine:

- Transfer funds between linked bank accounts

- Receive account balance

- Prints recent transactions list

- Change your pin

- Deposit your cash

- Prepaid mobile recharge

- Bill payments

- Cash withdrawal

- Perform a range of feature in your foreign language.

X . II

Working of Automatic Teller Machine (ATM)

Nowadays,

people do not carry money for shopping. Instead, they carry an automated

teller machine card, also known as ATM Card. When money is needed they

go to the nearby ATM machine, insert their ATM card, and take the

required amount. As these ATM machines are found in most of the

supermarkets, towns, and even hotels. Do you have any idea how your bank

money is received from any part of the country? In this post we will

describe briefly on how the ATM is networked with the bank and the

working of an ATM machine.

Difference between ATM card and Debit card

- Although both these cards serve the same purposes, most of the banks favour in the issue of credit cards. When you purchase something with a debit card, the money is automatically deducted from your savings account. This is different from the way a credit card works. For a credit card, you get a monthly bill for the amount you have spent. You can take money directly with the help of an ATM card. But, with a debit card, you can only purchase things. You can use ATM cards for some direct purchase as well, but it is limited.

- Debit cards can be used in different fields like grocery stores, hotels, booking tickets, pharmacies and so on.

- As credit cards are easier to use, some hotels and rental services often do not accept debit cards. Credit cards also bring in lesser risk and are also cheaper.

- There is a difference when using a credit card and a debit card when checking into a hotel. In the case of a credit card, the original amount will be billed in your account. When a debit card is used, a certain amount of money which includes the cost/rent of the room and an additional amount which may be a percentage of the total fee will be kept as an “on hold” bill in your bank account. The additional money is kept as a precaution as a damage money. When you check out of the hotel, you will be billed the original amount of your stay. But the difference between the “on hold” money and your actual money will be released back to your account.

- The next difference comes in the way you bill the amount. If it is a debit card, you will have to enter your unique pin number. If it is a credit card, you will have to sign a slip. Some banks even put a fee for your debit card.

- There is also a difference in appearance between an ATM card and a debit card. A debit card has the users name, the company’s logo, the bank’s logo and also written “Check card” in front of it. An ATM card, on the other hand has the user name, account number and also the bank logo. Both the cards have a common strip on the back of the card, so that the user can sign on it.

How ATM Works?

There are mainly two types of ATM’s which differ according to the way they operate. They can be called as

- Leased-line ATM

- Dial-up ATM machines

Any ATM machine needs a data terminal

with two inputs and four output devices. Of course, for this to happen

there should also be the availability of a host processor. The host

processor is necessary so that the ATM can connect and also communicate

with the person requesting the cash. The Internet Service Provider (ISP)

also plays an important role in this action. They act as the gateway to

the intermediate networks and also the bank computer.

A leased-line ATM machine has a 4-wire,

point to point dedicated telephone line which helps in connecting it

with the host processor. These types of machines are preferred in places

where the user volume is high. They are considered high end and the

operating costs of this type of a machine is very high.

The dial-up ATM machines only has a

normal phone line with a modem and a toll free number. As these are

normal connections their initial installation cost is very less and

their operating costs only become a fraction of that of a leased-line

ATM.

The host is mainly owned by the bank. It

can also be owned by an ISP. If the host is owned by the bank only

machines that work for that particular bank will be supported.

Parts of ATM machine

As told earlier, there are mainly two input devices and four output devices for an ATM. The input devices are

- Card Reader – This is a part of the identification of your particular account number. For this the magnetic stripe on the back of the ATM card is either swiped or pressed on the card reader so that it captures your account information. To understand the account information of the user, the data from the card is passed on to the host processor. The host processor thus uses this data to get the information from the card holder’s bank.

- Keypad – After the card is recognized, the machine asks further details like the type of withdrawal you prefer, your balance enquiry, and your personal identification number (PIN) and so on. Since each card has a unique PIN number, there is very little chance for someone else to withdraw money from your account. There are also separate laws to protect the PIN code while sending it to the host processor. So, the PIN number is mostly sent in encrypted form.

- Parts of an ATM machine

If your pin number is correct the ATM makes the necessary transactions for the required amount.

For this transaction, there are mainly four outputs. They are

- Speaker – When a particular key is pressed, the speaker provides the feedback as audio.

- Display Screen – The questions asked by the ATM machine regarding the transaction and the input from the user is all displayed on the display screen. Each step of withdrawal is shown by the display screen. A CRT screen or even an LCD screen is commonly used as an LCD screen.

- Receipt printer – All the details regarding your withdrawal like the date and time and the amount withdrawn and also the balance amount in the bank is also shown in the receipt. Thus a paper receipt of the current transaction is obtained by the user.

- Cash dispenser – This is the central system of the ATM machine. This is from where the required money is obtained. From this portion the person can collect the money.

Functions of the Cash Dispenser

As the whole mechanism is regarding the

withdrawal of cash, the cash dispenser should be highly efficient.

These are the main functions that are to be carried out by the cash

dispenser.

It is the duty of the cash dispenser to

count each bill and give the required amount. If there are cases where

the bills are stuck together they should be rejected and instead new

notes should be taken. If the money is worn, or even folded, they will

be moved to another section called the reject bin. All these actions are

carried out by high-precision sensors.

There may be cases where the sensors may

go wrong. To know this, the person responsible for the machine checks

the number of rejected notes at a certain interval. If the numbers of

notes are a lot than expected, then it would indicate that either the

quality of the bills is not good or there is a problem with the cash

dispenser.

A complete record of each transaction

made by a particular ATM machine is recorded each day and is kept as a

journal. This journal is later collected and then printed out at times.

This information regarding the transaction is kept by the authorities

for a period of 2 years. As there may be cases regarding a particular

transaction going wrong, the account owner or also the bank officers

have a right to see the transaction. With this printout the account

holder can contact the host processor.

ATM Networking

When a transaction is made, the details

are inputted by the card holder. This information is passed on to the

host processor by the ATM machine. The host processor checks these

details with the authorized bank. If the details are correct, the

requested cash by the card holder is taken with the help of an

electronic fund from the customer’s bank account to the host processor’s

account. After this function is carried out, the processor sends an

approval code to the ATM machine so that the cash can be transferred.

ATM Security

- An ATM card is secured as long as the PIN number is kept as a secret. There is no way to get the PIN number from your card as it is encrypted by strong software’s like Triple Data Encryption Standard. To keep your PIN number secure, there are a number of ways.

- Select your own PIN number. Select a PIN number which is easy to remember. It should not be anything that is associated to your birth date, phone number or anything personal. Do not write down the PIN number on the back of your ATM card.

Here are some tips on how to keep your ATM card safely.

- Your ATM card should be kept safely without being scratched or bent. Keep it in your purse or somewhere else safe.

- Take out the card from your purse before reaching the ATM counter. There is more chance for an attack if you are standing in front of the ATM.

- After entering the ATM counter close the door and then only turn around to the screen. Stand directly in front of the keypad, so that no one else sees the number you are pressing.

- After receiving the money, do not start counting the money right away. Put the money inside your purse at once. Keep the card also safely.

- There may also be cases where you may not receive the money because of a faulty ATM machine. In such cases, do not forget to take the ATM card.

- If you are ever forced to take the money out of an ATM machine by a stranger, just enter the number in the reverse order. For example, if your real PIN number is 1234 enter it as 4321. This will send a signal to the nearby police control room. Thus you can get help at the earliest.

Uses of ATM

- Since ATM machines are found almost everywhere, you need not have to carry a huge amount in your hand. Whenever you need money, you can take it from the nearby ATM counter. All you have to do is carry the ATM card wherever you go. Sine the ATM card has a unique password, no one can access it even if it is stolen.

- An independent ATM host can access any bank. It also supports a large number of ATMs placed with different merchants.

- There is also Braille equipped ATMs that provide access of money even to the blind and visually impaired people.

X . III

How Data Transfer Data Communication Works

1. Electronic Mail (Electronic Mail) Email is an application that allows Internet users to send each other messages via electronic address on the internet. Emails from start to write, sent, until received and read are all handled electronically. Generally email is created (or written) using Mail User Agent (MUA) more commonly known as Email client), then the delivery process is handled by Mail Transfer Agent (MTA) which is often also referred to as mail server. MUA is also used to open and read emails again. Method of sending E-mail To send electronic mail we need a mail-client program. The e-mail we send will go through several points before reaching the destination.

For more details see the diagram below. Examples used are SMTP and POP3 services. I am writing email → e-mail client (on my computer) → My e-mail provider's SMTP → Internet → POP3 e-mail recipient server provider → e-mail client (on the recipient's computer) → mail read by the recipient Visible electronic mail Which is sent only through 5 points (other than the sending and receiving computers). Actually more than that because after the electronic mail left POP3 Server then it will go through many other servers. It is possible that the electronic mail we send is intercepted by others. Therefore, if the electronic mail we send contains sensitive content, we should take precautions, by randomizing (encrypting) the data in the electronic mail (for example using PGP, digital certificates, etc.)

2. Bank Teller Terminal (ATM) ATM (Automatic teller machine is an abbreviation for automated teller machines) is an electronic tool that allows bank customers to take money and check their savings accounts without the need to be served by a human teller. Many ATMs also allow the deposit of money or checks, money transfers or even purchase stamps. With the current rapid technological developments, any transaction can be done through ATM, from cash withdrawal, transfer, transfer of book, bill payment, even cash deposit or printed book can be done at ATM. Atm system work (automatic teller machine) To perform various transactions at ATM, requires a customer's identity card in which there are names of customers, customer IDs, and others, which is usually called ATM CARD. And to obtain an ATM Card, a customer must first make an application to the bank to create an ATM CARD by meeting the requirements specified for the customer's identity. Then the bank will provide an ID Card or PIN as the customer's ATM Card ID. After getting the ATM Card, customers can directly use it as a requirement of Card activation. The PIN granted by the bank may be changed by the customer. The first step taken by the Machine is to read the customer ID card made by the magnetic card reader after the Card is inserted through the slot card into the machine. The function of the magnetic card reader is only as reader and receiver of data. Once read, then the data will be sent to the bank computerized system. Because its function is only as a data recipient then the magnetic card reader does not have memory that can store customer data. While the ATM Card will be stored in the machine and will exit automatically after nasbah disconnect the transaction. When the machine successfully reads the data in the ATM Card, then the machine will request data PIN. This PIN is not in the ATM card but must be input using the keyboard key ATM by the customer. After the PIN is entered, the PIN data will be encrypted with certain formula and sent to the bank computer system concerned. PIN data scramble is intended to send data that can not be read by other parties. The encrypted PIN and the contents of the data from the card will be sent directly to the bank's computer system for validation as part of each transaction. After the data is completed and processed in the bank's computer system, the data will be sent back to the ATM, and the customer will get what he asked for (transact) at ATM by following the optional instructions sent to the machine monitor machine. Customer needs to know that ATM machines do not store customer data or customer PIN. This is because the working principle of the ATM machine only passes the customer's pass through request to the bank's computer system. And ATMs can only serve one customer at a time. After the transaction is completed, the machine will print a number of transaction data that has been done (optional) or if customers do not want print data done, the machine will still provide the current transaction information through the machine monitor. And automatically, there will be a change in the number of customer balances. Steering

Then the card will come out of its slot and the transaction will be completely finished.

3.CREDIT CHECKING SYSTEMCurrently the use of credit cards is plural or can say already ngetrend. Because of the ease with which the use of credit cards is very helpful. How not, once swiped with a credit card we can buy or pay what we want. Like carrying a bank everywhere.Credit cards are a part of retail transaction settlement in the form of cards made of plastic. The credit card issuer (Bank) is the guarantor of the transaction made by the consumer (buyer) to the seller (merchant).Credit card parts.

Merchants have electronic verification tools that can identify which credit card used is valid or not, the limit of transactions allowed, this data is obtained from the magnetic tape that is behind the credit card. If still in effect the transaction resumes. Cardholders enter the PIN received from the issuing bank, the current account and you just wait for the bill from the card issuing bank and this is the most difficult,

4. Hotel Reservation System Hotel Reservation System which means Hospitality Booking Information System is one form of public service that offers a service in terms of administrative data collection on hotel reservation that requires accurate mechanisms and arrangements organized so that data can be packed and maintained properly in Database form. The database is created with the aim that the work process is more optimal and can be done quickly and precisely with the error rate that can be minimized. Danum Hotel is one of the hotel development projects in the city of Palangka Raya and of course requires a hotel management system Reservation that is able to provide convenience in the process of development of the hotel such as how the system interface that can facilitate the user (operator / part receptionist) of a hotel To access the system. As well as considered very necessary for the hotel should have a good database management so that in the future can see the required information of the activities of a hotel. 1. On the basis of considerations of some of the above, the authors are interested in creating a system with a computer to set information systems Hospitality reservation, where the authors develop it with Visual Basic 6.0 application program and Crystal Report, with access database using Ms Access with the title "Hospitality Booking Information System ".

5.TRAFIC CONTROL SYSTEM:Traffic light is one of the traffic control device, the determination of how many seconds the green, red and yellow time is done based on the calculation of the length of time on the basis of the amount of traffic flow into the intersection. The amount of traffic flow is surveyed and then the data is included in the formula for the best timing. But the magnitude of the current changes over time so that the timing is only matched by the timing of the survey. To improve the accuracy of the approach used is to perform data collection on a continuous basis by using Loop detector (planted below the road surface) or other detectors so that the time calculation is submitted to the controller (computer) to determine the best time.Coordination between intersections

Green waves at several consecutive junctionsThe problem that then arises is when the driver gets a green light at one intersection then until next dipersimpangan new lights become red berubanh, therefore one of the steps that is done is to coordinate between intersections so that when a vehicle to the next intersection will get a green light Again called the green wave.Consideration in regulating the green wave is the distance between intersections, the average vehicle velocity to set the next green intersection time called offset. The amount of offset is calculated using the formula:

Where:L = Offset, green time between the first intersection with the next intersection, secondsJ = The distance between the first intersection with the next, mV = Speed, m / secWhen the distance between the intersections is farther the effectiveness of the green wave will decrease, because the speed of the vehicle will not be the same throughout the journey so that when the distance between intersections is more than 2 km coordination becomes less effective. To improve the efficiency of coordination can be equipped with variable beacons that inform coordination is done at what speed so that drivers of vehicles through the area can adjust the speed.Area coordinationFurther steps that can be done is to make coordination between intersections in an area also known as Integrated Traffic Area or better known as Area Traffic Constrol System. To optimize control in the region, it is necessary to use software specifically planned for a region, because the variable / variable used not only the amount of traffic flow, but also the direction of traffic, the distance between intersections, the types of vehicles entering, vehicles that need priority Vehicle head of state, ambulance, firefighter, intersection form.Control Center

Very well explained the working of ATM,Advantages of ATM.ATM software provides superior visibility and management capabilities.

BalasHapusI was searching for loan to sort out my bills& debts, then i saw comments about Blank ATM Credit Card that can be hacked to withdraw money from any ATM machines around you . I doubted thus but decided to give it a try by contacting {Blankatmoffice@gmail.com} they responded with their guidelines on how the card works. I was assured that the card can withdraw $5,000 instant per day & was credited with $50,000.00 so i requested for one & paid the delivery fee to obtain the card, after 24 hours later, i was shock to see the UPS agent in my resident with a parcel{card} i signed and went back inside and confirmed the card work's after the agent left. This is no doubts because i have the card & has made used of the card. This hackers are USA based hackers set out to help people with financial freedom!! Contact these email if you wants to get rich with this Via: Blankatmoffice@gmail.com...

BalasHapusWESTERN UNION HACK/ MONEY GRAM HACK 2) BITCOIN INVESTMENTS HACK 3) BANKS TRANSFERS 4) CRYPTOCURRENCY MINING 5) BANKS LOGINS 6) LOADING OF ACCOUNTS 7) WALMART TRANSFERS 8) BUYING OF GIFT CARDS 9) REMOVING OF NAME FROM DEBIT RECORD AND CRIMINAL RECORD 10) BANK HACKING 11) PAYPAL LOADING 12) CASH-APP FLIP •

Very significant Information for us, I have think the representation of this Information is actually superb one. This is my first visit to your site. Celular virtual colombia

BalasHapus