Accounting is a data collection process of selling goods and services that are recorded either in a manual record or input data to a computer or through the internet network automatically, when I study a master's program in finance and when I work in a field that is related to financial transactions such as insurance, shares and banks there can be seen a financial transaction can be in the form of goods and services manifested into the money market and capital market and labor market these three market components have their own opportunities to support a credible accounting record so as to get a clean record, straightforward, firm and trustworthy so as to bring companies both the government and the public obtain authority. at a later time the labor market, capital market and money market transaction processes have evolved the recording of transactions is no longer manually but automatically recorded using sophisticated electronic devices such as sensors and electronic transducers working in the process of buying and selling in the third market above.

Existing transaction processes can be carried out electronically so that the number of goods and services recorded can be stored more, longer, more thorough, more coordinated, and analog and digital data can be more quickly analyzed so that decision making can be more responsive and reliable. in the future, many data input transaction tasks are replaced by Robotic so that the data is more validated, to reduce the effect of human errors and intentional errors for the benefit of certain interests or benefit some parties. let's review the development of existing accounting transactions.

Love Within e- S H I N to Tour Route for e- MAC

( Money & Account Currency )

Gen . Mac Tech Zone accounting process in the digital electronic process

Accounting & Financial Processes

Accounting is a process of identifying, measuring and reporting on economic information to allow for the assessment and decision making allow the assessment and decision of a clear and firm statement which uses the information.Objectives & Functions : Presenting economic information from an economic unit to the parties concerned.

Understanding Transaction (Transaction) Transaction is : a change that involves the three main elements of the accounting equation (assets, debt, & capital) .

Transaction Document: Each transaction needs evidence to ensure the validity of the recorded transaction.

Kind: Evidence of Money Spending (Receipt, Receipts).

Proof of Receipt of Money (Receipts)

Journal of Evidence (Journal of Vouchers)

Evidence of Transactions in Credit Credit (Invoice)

The Accounting Cycle: Stages of action in the recording process and the accounting reports, from the start of the transaction to the transaction until it is made in financial statements .

Estimates / Accounts or Accounts / Accounts are: special formulas used to record and classify types of transactions.

Journals (Journals) Journals are tools for stopping transactions that are carried out in chronological order (based on the timing of their occurrence) by showing accounts that are debited and credited with a number of each teacher.

_________________________________________________________________________________

Accounting & Financial Processes

Electronic Signatures, Integrations, PDF Generation.

Workflow Routing, Built-in Mobile, Conditional Logic.

Why improve Financial processes?

Every business relies on critical "back office functions" like finance and administration. They're vital to the success of day-to-day operations. Inefficient manual processes lead to bottlenecks that bog your business down.Benefits of Financial Process Automation

Fast, efficient approvals with fewer delays and errors ensure dependable communication and promote relationships.

Let employees & clients securely access data and digitally sign for approvals anytime, anywhere and on any device.

Use the Visual Rule Builder to connect business systems, validate data and perform calculations automatically.

Access control, configurable approvals, tracking and auditing provide strong compliance, visibility and oversight.

Process automation makes your business agile. The result is reduced complexity, higher productivity and customer focus.

Affordable, cloud-based business automation software offers massive cost savings that can be reinvested in digital.

Accounting must digitally transform to deliver business value

Business speed is increasing and accounting needs to be ready

As a new wave of digitization, powered by automation and AI, is

sweeping across the business landscape, accounting departments must

also change. They must deliver solutions with unprecedented speed

and agility to meet the demands of the modern business climate.

They must be able to mine proprietary business data, interpret

it and provide critical business insights.

Manual processes are a huge handicap

In spite of the urgency of digital transformation, many accounting

departments still rely on Excel- or paper-based processes for

everyday functions like approving purchase orders, and handling

travel requests. These manual processes are extremely

inefficient – your people spend their time chasing down

signatures, correcting errors and dealing with paperwork. It's

100% unproductive use of valuable time and talent.

The first step is to automate these routine processes using

workflow software

so that your people can focus on the work that matters.

Unlock your data

With manual processes, you don't have access to your

most valuable asset – your proprietary business data.

Process automation also digitizes data so that your finance

wizards can use modern tools to analyze it, learn from it,

make better decisions and improve compliance.

The case study Financial forms and workflows digitized

Top Procurement Trends

Recent advances in technology are creating profound impacts on many businesses activities. In particular, digital transformation is rapidly changing back-office operations such as supply chain management and procurement. Digitally transformed organizations increase efficiency, lower cost, and adapt to fast-evolving customer expectations. To stay relevant, competitive, and profitable .

Workflow Apps That Will Maximize Employee Productivity

Everyone wants a smooth workflow. The word itself says it all. You want the work to flow as you focus intensely and produce results with minimal time wasted. Yet we all know that’s not how our workdays turn out. Thankfully, there are tools you can use to get rid of distractions and time-consuming processes.

HR Functions to Automate for Business Efficiency

HR departments have gone through some changes in the recent years. Their responsibilities have shifted to be more aligned with the company’s overall goals rather than simply managing benefits and records-keeping for the workforce. Since talent is now the #1 challenge companies face, that means HR must focus on attracting, retaining, and developing the best .

_________________________________________________________________________________

Advantages & Disadvantages of Manual Accounting Systems

With the plethora of software options available for accounting and bookkeeping tasks, manual systems may seem a thing of the past. Yet double-entry manual accounting proves robust enough that many accounting applications re-create the features of the double-entry system within their software, such as the power and natural error-correction potential. When you weigh the options, manual entry systems may still have a place in your offices.

How Manual Accounting Works

Any contemporary accounting system records transactions relating to business activity with a view to communicating your company’s financial health to stakeholders, whether they are staff, bank managers or private investors. The systems is separated roughly into four cycles:- Revenue

- Purchase

- Payroll

- General Journal

Manual accounting systems use physical records, pads of paper and books, onto which transactions are entered by hand. Accounting pages have four or more printed columns and multiple rows, natural divisions for the necessary information, such as date, description and dollar amounts. Numerical entries typically have space for every digit.

Journals and ledgers comprise the working and final copies of documents, often with separate books for the various accounts. Cash sales could be one set, for example, while payroll may be another. The results of these working documents are usually combined in the company’s general ledger.

Advantage: Error Correction

Despite the convenience and market penetration of computer-based accounting systems, manual accounting still offers several advantages that make it a viable alternative. The first is error correction. Double-entry accounting, attributed to Luca Pacioli, a 15th century Italian, provides a natural way to guard against data entry errors and number transpositions. Every transaction gets entered as a debit in one account, and a credit in another account. Trial balances compare all debits and all credits. If these don’t match, an error is made somewhere in the accounts.Advantage: Data System Errors and File Corruption

Computer systems store data in ways that aren’t commonly understood by many users. Opening the wrong file with old data or encountering a data file with digital errors can ruin the validity of your current data. Manual systems use a single file, the ledger, for each account. There’s no other version with similar data that may be confused.Advantage: Always Accessible

Power or internet outages won’t prevent you from working on accounts unless you’re thrown into complete darkness.Disadvantage: Data Entry Errors

Double-entry accounting in a manual system is laborious, since every transaction must be recorded by hand, twice. Many accounting programs use a double-entry method, but second entry is created automatically. While this won’t stop a wrong number from being entered, it does eliminate discrepancies between the first and second entries.Disadvantage: Potential Loss of Physical Copies

While digital data can be corrupted, effective backups can protect data, including copies off-site, such as in cloud server storage. Journals and ledgers, being physical books, are prone to loss. Theft or fire could mean that all of a company’s accounting data is lost. Duplicating and storing the general ledger off-site can be a time-consuming task, compared with many digital storage options.Disadvantage: Knowledge of Accounting Procedures

Unlike many commercial software packages, manual accounting system aren’t optimized for ease of use, nor can you expect client support or proprietary help. A bookkeeper or accountant will be necessary to start up and maintain your manual accounting system._________________________________________________________________________________

EDI (Electronic Data Interchange)

Electronic Data Interchange (EDI) is the computer-to-computer exchange of business documents in a standard electronic format between business partners.

By moving from a paper-based exchange of business document to one that is electronic, businesses enjoy major benefits such as reduced cost, increased processing speed, reduced errors and improved relationships with business partners.Each term in the definition is significant:

- Computer-to-computer– EDI replaces postal mail, fax

and email. While email is also an electronic approach, the documents

exchanged via email must still be handled by people rather than

computers. Having people involved slows down the processing of the

documents and also introduces errors. Instead, EDI documents can flow

straight through to the appropriate application on the receiver’s

computer (e.g., the Order Management System) and processing can begin

immediately. A typical manual process looks like this, with lots of

paper and people involvement:

The EDI process looks like this — no paper, no people involved:

- Business documents – These are any of the documents that are typically exchanged between businesses. The most common documents exchanged via EDI are purchase orders, invoices and advance ship notices. But there are many, many others such as bill of lading, customs documents, inventory documents, shipping status documents and payment documents.

- Standard format– Because EDI documents must be

processed by computers rather than humans, a standard format must be

used so that the computer will be able to read and understand the

documents. A standard format describes what each piece of information is

and in what format (e.g., integer, decimal, mmddyy). Without a standard

format, each company would send documents using its company-specific

format and, much as an English-speaking person probably doesn’t

understand Japanese, the receiver’s computer system doesn’t understand

the company-specific format of the sender’s format.

- There are several EDI standards in use today, including ANSI, EDIFACT, TRADACOMS and ebXML. And, for each standard there are many different versions, e.g., ANSI 5010 or EDIFACT version D12, Release A. When two businesses decide to exchange EDI documents, they must agree on the specific EDI standard and version.

- Businesses typically use an EDI translator – either as in-house software or via an EDI service provider – to translate the EDI format so the data can be used by their internal applications and thus enable straight through processing of documents.

- Business partners – The exchange of EDI documents is typically between two different companies, referred to as business partners or trading partners. For example, Company A may buy goods from Company B. Company A sends orders to Company B. Company A and Company B are business partners.

__________________________________________________________________________________

Is Robotic Process Automation Right for Your Accounting Processes?

Are there robots in your accounting department? Just wait a few years, and they may be sitting right next to you.

It was only 20-plus years ago that you had to do business with large companies, like Walmart, using electronic data interchange (EDI). There are countless EDI transaction codes, including the 850 purchase order, the 856 shipping notice/manifest confirmation, the 810 invoice, and so forth.

The Arrival of Robotic Process Automation

Clearly, EDI was designed to reduce human interaction, processing errors, time, and cost. Now, companies are looking to further automate their repetitive accounting processes by employing robots. I'm not talking about the robots with big arms that you see on factory floors. I'm talking about software robots (bots) that process transactions and data according to defined business rules. Robotic process automation (RPA) is the use of programmed software to automate repetitive, everyday tasks, often, in support of existing employees.According to The Hackett Group's recent study titled "Raising the World-Class Bar in Finance Through Digital Transformation" about 67% of large global companies expect to automate some, or most, of their finance tasks over the next two to three years.

The study focused on mega companies, including Norway’s Statoil ASA, Royal Dutch Shell, and France’s Orange Telecom, but the trend is clear. All companies share a similar goal: to reduce costs and improve accuracy.

In

addition, companies are looking to redeploy people to higher value

tasks. For example, Orange Telecom plans to deploy RPA as a way to take

the place of some of the 30,000 people expected to retire by 2020.

According to the Hackett Group study, “Automation can cut error rates by

up to 66% and reduce time spent on data collection by 24%.”

Large companies often integrate RPA into their own systems, employing staff to create and support their bots. This makes for a nice return on investment (ROI) if the company has a large enough volume of transactions to support the $100,000 cost for software bots and staffing.

However, if your company is between $50 million and one billion dollars in revenue, a cloud-based solution from a shared services company might make better sense. These bots can be reused across companies, and expert staff can manage them for you. Since you pay based on volume, the ROI for cloud-based RPA is almost immediate.

If your company is looking for ways to use their staff more efficiently by removing repetitive tasks from their workload, reduce processing errors and time, and, perhaps, mitigate the need to replace retiring staff, then RPA is worth a look.

Is RPA for My Company?

A provider of RPA cloud services, “RPA has gained attention as one of the top instances of artificial intelligence in use today.” For example, accounting departments are increasingly using RPA to reconcile invoices with payments. RPA is not limited to mundane tasks either, because with machine learning, the technology will be able to complete work based on the patterns it detects in a process.Large companies often integrate RPA into their own systems, employing staff to create and support their bots. This makes for a nice return on investment (ROI) if the company has a large enough volume of transactions to support the $100,000 cost for software bots and staffing.

However, if your company is between $50 million and one billion dollars in revenue, a cloud-based solution from a shared services company might make better sense. These bots can be reused across companies, and expert staff can manage them for you. Since you pay based on volume, the ROI for cloud-based RPA is almost immediate.

If your company is looking for ways to use their staff more efficiently by removing repetitive tasks from their workload, reduce processing errors and time, and, perhaps, mitigate the need to replace retiring staff, then RPA is worth a look.

_________________________________________________________________________________

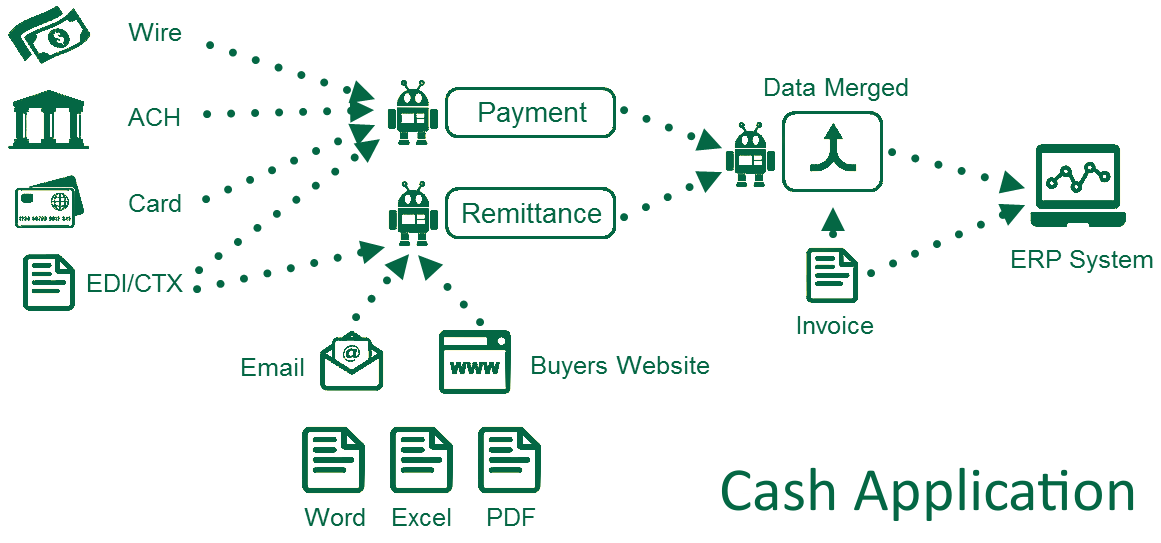

What is Cash Application and Why is it Important?

For those who deal with cash application on a daily basis, what cash application is and why it is important is probably pretty obvious, but for those who don’t know what cash application is, it may be a little difficult to fully understand why it is so important. While it can seem simple on the surface, there is a lot of complexity to cash application. For those with questions, we’ll look to answer what cash application is, how you do it, why it is complex, and why any of this matters.

What is cash application?

Cash application is a part of the accounts receivable process that applies incoming payments to the correct customer accounts and receivable invoices. In order to do this, the first step is to determine where to apply the payments. This is normally done by matching the payment to the associated invoices. If for some reason the payment cannot be correctly matched to its associated invoice then the payment is matched to the customer at the customer account level. Once this is done, the payment can be applied to reduce accounts receivables. Seems pretty simple, so let’s move into how cash application is done.How do you do cash application?

Cash application is one of the most important components of any accounts receivable process. At the highest level, there are two ways that cash application is done, manually or automated. A manual process involves a cash application specialist going through payments and associated remittance and matching the payment amounts with their associated invoices. The cash application specialist will look at the customer name or invoice number on the payment, find the associated remittance and post it to the outstanding accounts receivable invoice in their company’s ERP. An automated cash application process goes through the same process, but is able to match payment and remittance at a must faster speed. As the cash application process has grown more and more complex, many companies have moved to an automated process, as reducing the staff work load to reduce costs and work burnout and applying cash becomes more important.What makes cash application complex?

The fact is that cash application was not always complex. When being paid by check, cash application was pretty straightforward for accounts receivables teams; checks would come in with remittance advice attached, allowing for a simple one to one matching that was basically already completed. Many accounts payable teams have adopted electronic payments to reduce costs. With the advent of electronic payments – ACH, wire and card – remittances often now comes separate, via mail, email, web portals, or other sources.Another issue occurs when accounts payable departments send a single electronic payment for multiple invoices. This makes matching a much more difficult process since you can’t just look at dollar amounts of payments to match proper payments to the invoices. The remittance now becomes vital as it is the only means of relating the payment to the correct invoices.

A newer problem for accounts receivable departments is the requirement of retrieving remittances from web portals. The prominent shift occurred in 2014 when Wal-Mart, Amazon, and many other buyers set up web portals as a cheaper way to distribute remittance to vendors. These large retailers usually dictate the process, making it hard for their suppliers to avoid the burden and costs of retrieving remittances from web portals. The suppliers have to comply because they can’t afford to lose business!

When these challenges come together, it is easy to see why accounts receivable teams are stressed and overworked. On top of all this, cash application is a time-sensitive process; its speed and efficiency directly affects a business’s performance. In a manual process, a cash application specialist has to retrieve all of the remittances, from mail, email, web portals, and more just to begin.

For companies that work with multiple retailers and receive remittances daily, just retrieving remittances from web portals requires multiple full time employees. Then they have to use the remittance information to match the payments to the associated invoices to post them to the ERP.

Automation of cash application has allowed companies to eliminate routine tasks in the process. A centralized archive can be set up for storing all remittances. Robotic Process Automation (RPA), a form of automation that we will discuss in a later blog, can retrieve remittances from the web portals and receive emails and extract the remittance information. From there, remittances from all sources can be put in a centralized archive, eliminating the issue facing cash application teams that work with multiple sources of remittance information. RPA can also automate the matching.

Whether a company decides to automate one part of the cash application process or the entire process, one thing is clear, automation leads to faster cash application. That brings us to our next section.

Why does cash application matter?

You’ve probably heard the phrase “put it in the books!” Cash application is how payments get applied to the books. Many payments are point-of-sale, where a payment is issued, and then goods are received. This is how many B2C transactions work. However in the B2B world, something is sold and payment usually won’t arrive until later. When the seller receives payment, they need to apply the cash to track cash flow to maximize cash utilization. If you can’t use it, it might as well not be there!With an efficient cash application process, the faster cash is applied results in a lower Days Sales Outstanding (DSO), the time between sales and completed payment. A lower DSO means that you will have more capital to invest in other opportunities or use in everyday business. With a poor cash application process, a company will is not able to accurately monitor cash flow and capital, leading to other missed opportunities, like sales etc. The bottom line is “cash is king” and cash application is key factor for any successful accounts receivable department.

_________________________________________________________________________________

Accounting Information Systems

An accounting information system (AIS) is a structure that a business

uses to collect, store, manage, process, retrieve and report its

financial data so it can be used by accountants, consultants, business

analysts, managers, chief financial officers (CFOs), auditors,

regulators, and tax agencies.

Specially trained accountants work in-depth with AIS to ensure the

highest level of accuracy in a company's financial transactions and

record-keeping, as well as make financial data easily available to those

who legitimately need access to it—all while keeping data intact and

secure.

Accounting information systems

generally consist of six primary components: people, procedures and

instructions, data, software, information technology infrastructure, and

internal controls. Let's look at each component in detail.

Introduction To Accounting Information Systems

1. AIS People

The people in an AIS are simply the system users. Professionals who

may need to use an organization's AIS include accountants, consultants,

business analysts, managers, chief financial officers, and auditors. An

AIS helps the different departments within a company work together.

For example, management can establish sales goals for which staff can

then order the appropriate amount of inventory. The inventory order

notifies the accounting department of a new payable. When sales are

made, salespeople can enter customer orders, accounting can invoice

customers, the warehouse can assemble the order, the shipping

department can send it off, and the accounting department gets notified

of a new receivable.

The customer service department can then track customer shipments and

the system can create sales reports for management. Managers can also

see inventory costs, shipping costs, manufacturing costs and so on.

With a well-designed AIS, everyone within an organization who is

authorized to do so can access the same system and get the same

information. An AIS also simplifies getting information to people

outside of the organization, when necessary.

For example, consultants might use the information in an AIS to

analyze the effectiveness of the company's pricing structure by looking

at cost data, sales data, and revenue. Also, auditors can use the data to assess a company's internal controls, financial condition and compliance with the Sarbanes-Oxley Act (SOX).

The AIS should be designed to meet the needs of the people who will

be using it. The system should also be easy to use and should improve,

not hinder efficiency.

2. Procedures and Instructions

The procedure and instructions of an AIS are the methods it uses for

collecting, storing, retrieving and processing data. These methods

are both manual and automated. The data can come from both internal

sources (e.g., employees) and external sources (e.g., customers' online

orders). Procedures and instructions will be coded into AIS

software—they should also be "coded" into employees through

documentation and training. To be effective, procedures and instructions

must be followed consistently.

3. AIS Data

To store information, an AIS must have a database structure such as

structured query language (SQL), a computer language commonly used for

databases. The AIS will also need various input screens for the

different types of system users and data entry, as well as different

output formats to meet the needs of different users and various types of

information.

The data contained in an AIS is all the financial information

pertinent to the organization's business practices. Any business data

that impact the company's finances should go into an AIS.

The type of data included in an AIS will depend on the nature of the business, but it may consist of the following:

- sales orders

- customer billing statements

- sales analysis reports

- purchase requisitions

- vendor invoices

- check registers

- general ledger

- inventory data

- payroll information

- timekeeping

- tax information

This data can then be used to prepare accounting statements and reports, such as accounts receivable aging, depreciation/amortization schedules, trial balance,

profit and loss, and so on. Having all this data in one place—in the

AIS—facilitates a business's record-keeping, reporting, analysis,

auditing, and decision-making activities. For the data to be useful, it

must be complete, correct and relevant.

On the other hand, examples of data that would not go into an AIS

include memos, correspondence, presentations, and manuals. These

documents might have a tangential relationship to the company's

finances, but, excluding the standard footnotes, they are not really

part of the company's financial record-keeping.

4. AIS Software

The software component of an AIS is the computer programs used to

store, retrieve, process, and analyze the company's financial data.

Before there were computers, an AIS was a manual, paper-based system,

but today, most companies are using computer software as the basis of

the AIS. Small businesses might use Intuit's Quickbooks or Sage's Sage

50 Accounting, but there are others. Small to mid-sized businesses might

use SAP's

Business One. Mid-sized and large businesses might use Microsoft's

Dynamics GP, Sage Group's MAS 90 or MAS 200, Oracle's PeopleSoft or

Epicor Financial Management.

Quality, reliability, and security are key components of effective AIS software.

Managers rely on the information it outputs to make decisions for the

company, and they need high-quality information to make sound decisions.

AIS software programs can be customized to meet the unique needs of

different types of businesses. If an existing program does not meet a

company's needs, the software can also be developed in-house with

substantial input from end users or can be developed by a third-party

company specifically for the organization. The system could even be

outsourced to a specialized company.

For publicly-traded companies, no matter what software program and

customization options the business chooses, Sarbanes-Oxley regulations

will dictate the structure of the AIS to some extent. This is because

SOX regulations establish internal controls and auditing procedures with which public companies must comply.

5. IT Infrastructure

Information technology infrastructure is just a fancy name for the

hardware used to operate the accounting information system. Most of

these hardware items a business would need to have

anyway, including computers, mobile devices, servers, printers, surge

protectors, routers, storage media, and possibly back-up power supply.

In addition to cost, factors to consider in selecting hardware include

speed, storage capability and whether it can be expanded and upgraded.

Perhaps most importantly, the hardware selected for an AIS must be

compatible with the intended software. Ideally, it would be not just

compatible, but optimal—a clunky system will be much less helpful than a

speedy one. One way businesses can easily meet hardware and software

compatibility requirements is by purchasing a turnkey system that

includes both the hardware and the software that the business needs.

Purchasing a turnkey system means, theoretically, that the business will

get an optimal combination of hardware and software for its AIS.

A good AIS should also include a plan for maintaining, servicing,

replacing and upgrading components of the hardware system, as well as a

plan for the disposal of broken and outdated hardware so that sensitive

data is completely destroyed.

6. Internal Controls

The internal controls of an AIS are the security measures it contains

to protect sensitive data. These can be as simple as passwords or as

complex as biometric identification. An AIS must have internal controls

to protect against unauthorized computer access and to limit access to

authorized users, which includes some users inside the company. It must

also prevent unauthorized file access by individuals who are allowed to

access only select parts of the system.

An AIS contains confidential information belonging not just to the

company but also to its employees and customers. This data may include

Social Security numbers, salary information, credit card numbers, and so

on. All of the data in an AIS should be encrypted, and access to the

system should be logged and surveilled. System activity should be

traceable as well.

An AIS also needs internal controls that protect it from computer viruses, hackers and other internal and external threats to network security. It must also be protected from natural disasters and power surges that can cause data loss.

How an AIS Works In Real Life

We've seen how a well-designed AIS allows a business to run smoothly

on a day-to-day basis or hinders its operation if the system is poorly

designed. The third use for an AIS is that, when a business is in

trouble, the data in its AIS can be used to uncover the story of what

went wrong.

In 2002, WorldCom internal auditors Eugene Morse and Cynthia Cooper

used the company's AIS to uncover $4 billion in fraudulent expense

allocations and other accounting entries. Their investigation led to the

termination of CFO Scott Sullivan, as well as new legislation — section

404 of the Sarbanes-Oxley Act, which regulates companies' internal

financial controls and procedures.

When investigating the causes of Lehman's collapse, a review of its

AIS and other data systems was a key component, along with document

collection and review, plus witness interviews. The search for the

causes of the company's failure "required an extensive investigation and

review of Lehman's operating, trading, valuation, financial, accounting and other data systems," according to the 2,200-page, nine-volume examiner's report.

Lehman's systems provide an example of how an AIS should not be structured. "At the time of its bankruptcy

filing, Lehman maintained a patchwork of over 2,600 software systems

and applications... Many of Lehman's systems were arcane, outdated or

non-standard."

The examiner decided to focus his efforts on the 96 systems that

appeared most relevant. This examination required training, study, and

trial and error just to learn how to use the systems.

Noted, "Lehman's systems were highly

interdependent, but their relationships were difficult to decipher and

not well-documented. It took extraordinary effort to untangle these

systems to obtain the necessary information."

Intelligent automation: Building the digital finance workforce of tomorrow

Financial process automation solutions are not designed to link to multiple, disparate internal and external sources to access or integrate data,

Intelligent automation can build a

digital finance workforce of tomorrow where the collaboration between

digital and physical workers results in greater organizational capacity

and employee empowerment.

With financial process automation, organisations can now streamline and speed the purchase-to-pay, order-to-cash and record-to-report cycles by capturing and extracting information from any source, automatically routing it into an approval workflow, and transferring information into the system of record. However, although the ERP system is the powerful core of your customers’ financial operations, it has its limitations.

Most organisations are still forced to allocate employees to tackle the time-consuming, manual work to process information from third-party sources or to handle those tasks that are unique to their business. Therefore, even if financial process automation has already been implemented, there are likely significant workflow gaps and blind spots that can debilitate decision-making and ultimately strain customer and vendor relationships.

Automating accounts payable: RPA, fuzzy logic and turning black lists into the black

First there was pen and paper, then there were spreadsheets, now it is the automation of accounts payableFinancial process automation is only part of the equation

Let’s assume an organisation has adopted financial process automation technology and perhaps built service-oriented architectures to enable applications to work together. Even though these systems can acquire data from multiple sources, enhancing and properly delivering the information likely requires some significant IT skills. The challenge is further compounded when dealing with automating processes that span across internal enterprise applications and external partner and customer systems, websites, online services, and so on.The bottom line: financial process automation solutions are just not designed to link to multiple, disparate internal and external sources to access or integrate data, or the myriad of other manual tasks that are unique to a business.

Further complicating matters is the fact that as a business grows, with more data comes more complexity; it’s easy to revert to adding more resources to address the problems. But there’s a better way than throwing people at the issue or investing in expensive custom development to try to work around the ERP.

Bridge the process automation gaps with RPA and intelligent automation

Enter robotic process automation (RPA), a powerful capability that seems purpose-built to bridge the automation gaps in finance and accounting processes.

RPA is designed to serve as a complement —not a replacement — to an existing finance and accounting automation workflow and can scale to meet the needs of any size accounting firm or organisational finance department. Because RPA sits on top of an organisation’s existing technology, it works well with installed core systems and can be implemented quickly to minimise operational disruption to day-to-day business. RPA uses software robots to mimic specific rules-based actions a person takes while working on a computer (but with 100% accuracy) and is ideal for covering those remaining tasks within workflows that have historically been difficult to automate.

Use Case: Invoice Processing

A global telecommunications provider received 1,000 pieces of mail every day in AP, mostly invoice-related, and they relied on inefficient, manual processes.Before process automation:

- 14 days to process an invoice (on average)

- 2-3% late fees after frequent inability to meet supplier payment terms

After process automation:

- 1-2 days to process an invoice

- 400% increase in productivity

This is where RPA shines.

In short, RPA empowers organisations to delegate the time-consuming, error-prone manual tasks to the robots, and elevate employees to focus on more strategic, higher-value tasks. Exactly where RPA is best applied within a particular organisation or department will depend on its most pressing current priorities and long-term goals.

Use Case: Procure-to-pay

A premier transportation provider enabled customers to request pick-ups via email; however, CSRs were tasked with manually re-keying shipment details from the emails into an internal scheduling application, as well as the shipper’s portal.Before Process Automation:

- Manually access 70+ partner portals—with different logins, navigation, transactions and reports

- Cost-prohibitive: Each CSR could barely service 1 premium customer

After Process Automation:

- 100% of manual, routine work eliminated

- 90% to 95% of employee time is reclaimed for higher-value work.

- No costly transcription errors

Intelligent Automation – Realizing the promise of true end-to-end digital transformation

Often, when your customers are asked to evaluate their automation priorities, a question emerges: What if I want to extend beyond bridging the manual task gaps in my workflow with RPA and take my processes to the next level of optimization and productivity?It’s clear that ‘onboarding’ software robots as the digital workforce to handle the repetitive, rules-based tasks that drain critical employee time and brain power continues to prove its value. Yet many organisations are finding that their business operations are becoming increasingly complex due to the vast amounts of unstructured data found in documents and emails, mobile transactions, electronic signatures, exception handling, biometric authentication/validation, case management and customer communications.

Addressing these process and data complexities requires a next-generation, unified intelligent automation platform that bundles analytics and cognitive technologies with RPA to automate more end-to-end processes, while driving greater value:

Consider the following example of the intelligent automation framework optimizing a typical finance and accounting process:

- Before intelligent automation, an employee keys in invoices or sales orders manually; this is inherently slow and introduces the risk of human errors and significant delays.

- An Intelligent Automation framework ingests the data (any format); automatically classifies and extracts the data; integrates the information with the ERP (SAP, Oracle, etc.); analyses the performance of not just the platform capabilities and whether they executed as intended, but provides insights on the invoicing or sales order process; and delivers those real-time insights to executives in the exact format they want to receive for optimizing financial and operational performance.

The end result is a truly automated process workflow that connects the back office to the front office. Customers are empowered to not only scale, but also to measure the benefits and ROI of their process automation deployment.

Therein lies the real power of an intelligent automation platform: building a digital finance workforce of tomorrow where the collaboration between digital and physical workers results in greater organizational capacity and employee empowerment.

_________________________________________________________________________________

To Use Technology In Your Business

Technology can help small business owners leverage limited capital in

smarter, more effective ways. In some cases, using technology provides

greater efficiency and versatility, making it a natural progression for

processes you may already have in place in your business. In others, you

may need to make some adjustments to reap the benefits of tech-friendly

alternatives.

The good news is that the benefits often outweigh the short-lived

challenges of the transitional process, once new systems are in place.

Here are some areas to explore when you're ready to ramp up your use of

technology in your business.

Productivity

1. Time tracking software

is an excellent tool for mapping out where time is spent, by whom. Such

analysis when properly utilized is great for accountability, process

improvement, and productivity.

2. Streamline your work processes with digital dictation.

3. Use project management and task management tools to stay on top of your daily business responsibilities.

4. Create a digital filing system to make it easier to sort, save, share and find documents.

5. Develop an efficient email management process that makes it easier to stay on top of the flow of messages.

Financials

6. Use an online invoicing service to reduce the costs of collecting payment from customers.

7. Use online budget tracking to keep on top of—and reduce—your expenses.

8. File your taxes more efficiently online.

9. Create a new income stream by selling your products online.

10. Use a comprehensive accounting software to streamline your business finances.

11. Share digital files with your bookkeeper or accountant to improve your ongoing bookkeeping processes.

12. Explore open source applications to replace some of the more costly "name brand" alternatives

Marketing

13. Use software to create a marketing plan that you can edit, update and share with your team.

14. Use social media sites like Facebook, Twitter, Google+, Pinterest, YouTube, etc. to promote your business, products, and services.

15. Start a blog related to your business and target audience.

16. Collect email addresses through an opt-in form and start utilizing the power of email marketing.

17. Use video marketing.

18. Promote your business with a website and/or online advertising.

Collaboration and Learning

19. Conduct teleconference calls to make sure team members in different locations are on the same page.

20. Webinars or web conferences are great for keeping everyone in the loop with travel-free face-to-face time.

21. Expand your knowledge and empower your team with online business training.

22. Share files and data with the cloud.

23. Set up an Intranet for local file sharing.

24. Communicate quickly and clearly with your team through team messaging.

Customer Service

25. Use social media to conduct customer service.

26. Set up an online help desk or ticket system to handle customer issues.

27. Allow clients to schedule appointments online at their convenience.

28. Use online surveys and questionnaires to get customer feedback.

Mobile Working and Telecommuting

29. Create a mobile office that allows you to work productively from anywhere.

30. Try a remote desktop application to access files on your office computer.

31. Go paperless to save money on supplies and storage in your office. Added bonus: environmentally-sound choices are cool!

32. Get a virtual phone number and electronic fax line that you can take anywhere.

33. Use your smartphone and select apps that sync with the cloud to stay connected when you're on the go.

_________________________________________________________________________________

Gen . Mac Tech Zone e- S H I N to A / D / S Tour Route within Accounting Electronic Transaction

_________________________________________________________________________________