Money is the most dominant human transaction tool in modern human life, even human life is always in contact with money both in communication and in association because money demands value and form of authority of a person or family, when money is used as a tool for transactions money has value added by the rotation of regional and national and international money transactions, money for individuals and groups and countries shows the ability and legitimacy of those who have it that a person or group and country has the ability to develop and move forward for innovation and research in various fields of technology. the velocity of money is faster, the development of money and interest from the quality of money is also more beautiful and quality. money in the practice of human life has its own place in our lives from the past to the present, where now money has a faster turnaround speed and is more transparent and accountable than when it used currency and demand deposits or more backward that is barter (barter = where money has no advanced meaning yet). electronic money allows more money and faster technological developments in various fields, but there are obstacles when it comes to the regulation of life in various countries on earth. movement of money economy because the people who are still not ready to move quickly. Today's humans live without money like side dishes without salt and without lighting where we do not know what is served and do not know how to process it and enjoy it from all that God has given to us all on earth. we should thank the Father who belongs to heaven that he gives us the resources that we can manage well and with good added value and good transaction tools that are faster and more precise and accurate so that technological developments can be achieved appropriately as well as prosperity evenly distributed in all places and changing human mentality to be more solid that cannot be swayed by the flow of dramatic life

LOVE ( Line On Victory Endless )

Gen. Mac Tech Zone e- speed of rotation of electronic money

A. XO Transforming Money

finance was transformed from a clubby world of cozy relationships to a mathematical one of complex securities, abstract formulas and computing power. Now, a generation later, the financial industry is about to be remade once again, except this time, it is not obscure financial securities that are being transformed, but very nature of money itself.

What is Money?

Money : It was a much more efficient way to transact business than bartering one good for another. Money was also a useful store of wealth, certainly more convenient than livestock or grains. These two core functions—a medium of exchange and a store of value—still define money today.

Many people object to the concept of fiat money because of the control governments have over it. Central banks can increase or decrease the money supply at will, giving them enormous control over economic activity. In extreme cases, hyperinflation can ensue, debasing the currency and wreaking havoc.

So it’s not surprising that innovating the concept of money through a digital currency has been a recurring theme in technology circles. Intuitively, it seems that the global financial system should be based on more than the judgments of a small group of central bankers. Yet only recently has digital money actually become possible.

Another solution would be to create unforgeable signatures, which is what digital technology makes possible (digital signatures have been around for some time). Moreover, in digital form, these signatures can be distributed—both instantly and ubiquitously—making it an ideal vehicle for an alternative currency to fiat money.

It works through a widely distributed digital ledger, which makes it not only super secure, but also incredibly efficient because payment processing is automatic.

Further, it is unlikely that a digital currency will ever displace national ones like the dollar. As long as governments have the power to tax, they have the power to demand payment in whatever form they choose. Invariably, that will be a national currency.

Facilitating Transactions

While digital currencies are unlikely to impact national currencies’ role as a store of value, there is vast potential in using vehicles like Bitcoin as a medium of exchange. Consider that Visa and Mastercard make over $30 billion per year in interchange fees and you can see the possibilities. Bitcoin can do a far better job at a much lower cost.

Remember that Bitcoin has a widely distributed ledger, so it’s much more impervious to attack than a centralized institution like a bank. It also transacts business instantaneously, so there is no “float” (i.e. the bank can’t keep your money in limbo while it earns interest on it) and because processing is automated, fees can be lowered substantially.

TechCrunch describes another interesting aspect of digital currencies, the ability to program currency to create new financial products with functionality built in. Imagine being able to set up an automated escrow account or a trust on your smartphone, with no lawyers involved.

Digital currency is still a very new concept and these are merely initial ideas. Surely, as the market and technology matures, more useful applications will arise.

Money has always been intertwined with centralized power. Only governments could issue it and only banks had the resources to facilitate transactions. That model worked well enough, but had obvious drawbacks. Many were shut out of the system while others earned fortunes as gatekeepers.

The revolution underway in finance going on now has the potential to be even more consequential than the one that happened back in the 70's. While financial innovation transformed many practices in the industry, its institutions remained intact. The financial world today is still lorded over by a relatively small collection of bankers, clearing houses and regulators.

Digital technology, however, is making finance exponentially more democratic. Crowdfunding and microlending have made it possible for people to acquire financing who never could before. New payment systems like Square, Paypal and Apple Pay have made it easier for merchants to accept electronic payment.

SYSTEM AND METHOD FOR PROTECTING ELECTRONIC MONEY TRANSACTIONS

Yet digital currency is something else altogether because it represents a decentralized form of money that is more secure, more fungible and more functional than anything we’ve seen before. More than a mere store of value or medium of exchange, digital money has the potential to be more transformative than anything we’ve seen before.

B. XO Transforming Aspect Real MONEY To e- MONEY

The value of money at the moment is experiencing a significant shift where the amount of wealth that can be owned by individuals can increase and increase all because of the availability of financial transactions in instrumentation and measurement in the method of financial electronics. when we are in the real money era, namely currency and demand, we always have a variety of physical evidence of the value of money, either in the form of whole or in the form of checks, can go forward or check backwards, and withdrawals are limited and require space and the place also takes a lot of time in making the value of money as a transaction tool which of course greatly nullifies a business in a mega project that requires fast and limited cash flow in times and times that are fast and appropriate in disbursing the value of money to customers, owners and founders also every member of the community who is competent in the business of value money. in the era of industry that is growing rapidly, especially the attraction of pure technology for industrial processes that are prolonged and developing continuously, transaction tools are needed that can move the economic rotation on a macro and cash basis in a micro manner quickly, precisely and easily and credibly can also be accountable. makes it easy for us to develop new and renewable industrial methods and techniques for excavating techniques on planets outside the earth and the solar system.

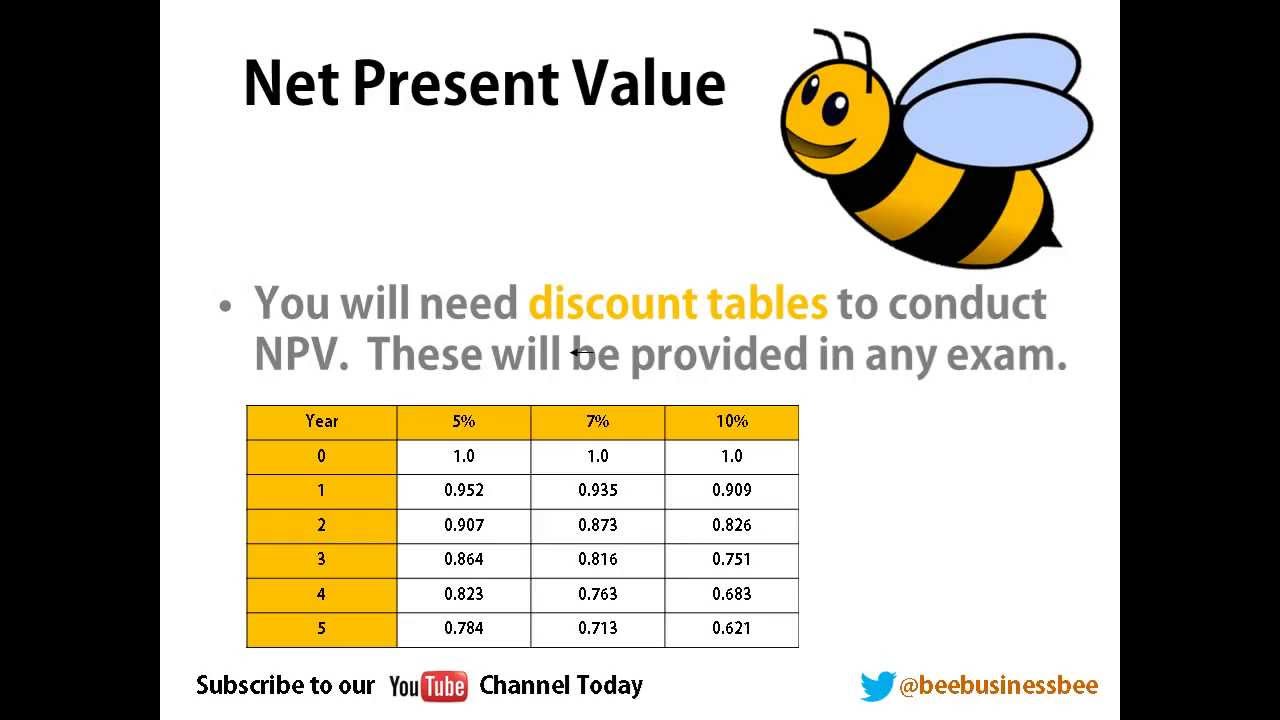

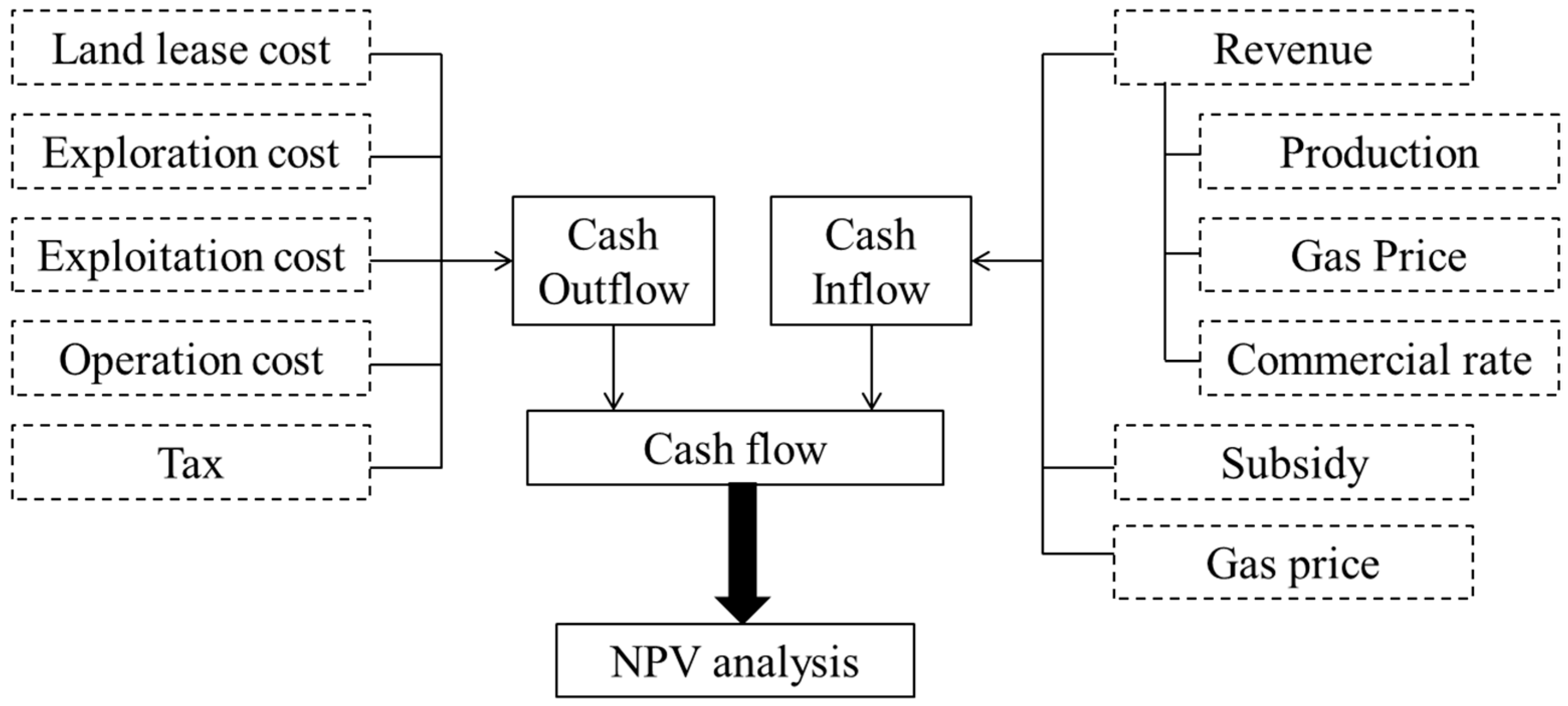

some comparative tool for the value of money that is now on earth as we know it is NPV, where the NPV value in the era of financial electronics transactions will accelerate and slow down which is more measurable and controlled and reduces human error both intentional and incidental:

1. The NPV in the micro sense is the difference between disbursed expenditure and income by using the social opportunity cost of capital as a factor discount, or in other words a cash flow that is expected to be discounted in the future.

2. NPV in the sense of macro is money in the present is worth more than the same as inflation, and earnings from alternative investments that can be made during the intervening time. In other words, a dollar earned in the future won't be as much as one earned in the present.

the main difference between the profitability index and net present value

how in the era of real money when people or individuals could hoard money such as hoarding rice and wheat barns and corn that needed a place, moths and rust could damage it and require up-to-date maintenance and maintenance costs and this raises the value of money which drops dramatically. our tendency to return to the era of the Barter era in which without proper management of the value of money but in the era of financial electronics all did not need to be stockpiled such as hoarding rice, corn and wheat but kept in the place of financial electronics which were also more private and safe to manage without super tight guard because it has been protected by a system of qualified financial electronic instruments and measurements. of course the value of money transactions are more useful and efficient are also effective and penetrate the value of money for better and more effective prosperity as well as energy for all of us.

C. XO Discounted Cash Flow and the Time Value of Money Aspect

Time value of money concepts are the cornerstone of modern finance. finance.

What are "Discounted Cash Flow" and the "Time Value of Money?"

Discounted cash flow DCF is an application of the time value of money concept—the idea that money that will be received or paid at some time in the future has less value, today, than an equal amount collected or paid today.

The DCF calculation finds the value appropriate today—the present value—for the future cash flow.The term "discounting" applies because the DCF "present value" is always lower than the cash flow future value.

In modern finance, "time value of money" concepts play a central role in decision support and planning. When investment projections or business case results extend more than a year into the future, professionals trained in finance usually want to see cash flows presented in two forms, with discounting and without discounting. Financial specialists, that is, want to know the time value of money impact on long-term projections.

Two Central Terms: Present Value and Future Value

In discounted cash flow analysis DCF, two "time value of money" terms are central:

- Present value (PV) is what the future cash flow is worth today.

- Future value (FV) is the value that flows in or out at the designated time in the future.

A $100 cash inflow that will arrive two years from now could, for example, have a present value today of about $95, while its future value is by definition $100.

- For each cash flow event, the present value is less than the corresponding future value, except for cash flow events occurring today, in which case PV = FV).

- The further into the future before a cash flow event occurs, the more discounting lowers the present value below its future value.

- the total of all of the cash flow present values for the cash flow series, across a timespan extending into the future, is the net present value (NPV) of a cash flow stream.

DCF is center stage when decision makers and investors evaluate potential investments, action proposals, or purchases. Looking forward in time, the analyst projects cash inflows and outflows (cash flow streams) the investor can expect from each of these. Other things being equal, analysts will recommend the action or investment with the more substantial cash flow NPV, as the "better business decision."

When first hearing the definition of discounted cash flow, many people understandably react with comments like these: "It sounds like fiction" or "The time value of money cannot refer to real value because DCF does not measure real cash flow" or "It's an interesting calculation, but there's no tangible value involved."

However, business professionals recognize that the results of discounting calculations do represent real tangible value, readily seen when they state the time value of money concept like this:

Having the use of money for some time has a value that is tangible, measurable, and real.

Discounted cash flow (DCF) is one application of this concept, while interest paidfor a loan is another. With DCF, the discounting lowers the present value PV of future funds below the future value FV of the funds for at least three reasons:

- Opportunity.

Funds you have now could (in principle) be invested now, and gain return or interest between the present and the future time. You cannot use now funds that you will not have until a "future" time. - Risk.

Funds you have now are not at risk, but funds arriving in the future are uncertain. A well-known proverb states this principle more colorfully: "A bird in the hand is worth two in the bush." - Inflation.

A sum you have today will very likely buy more than an equal amount you will not have until years in future. The buying power of money decreases over time due to inflation.

What future money is worth today is called its present value (PV) and what it will be worth in the future when it finally arrives is called not surprisingly its future value (FV).

The right to receive a $100 payment one year from now (the future value) might be worth to us today $95 (its present value).

Present value, in other words, discounts to a value below future value.

Present Values for a Cash Flow Stream

When the analysis concerns a series of cash inflows or outflows coming at different future times, the series is called a cash flow stream. Each future cash flow has its value today (its present value). The sum of these "present values" is the "net present value" for the cash flow stream.

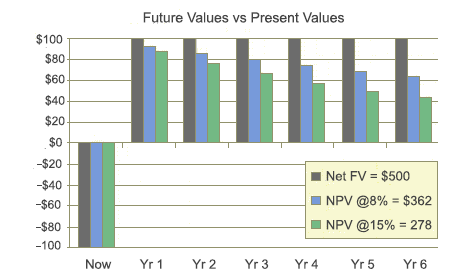

Consider an investment today of $100, that brings net gains of $100 each year for six years. The future values and present values of these cash flow events might look like this:

All three sets of bars represent the same investment cash flow stream.

- Black bars stand for cash flow figures in the currency units when they arrive in the future (future values).

- Green and Blue bars are values of the same cash flows now, in present value terms.

- The net values in the legend show that after five years, the net cash flow expected is $500, but the Net present value (NPV) today is discounted to something less.

The next section explains the role of the discount rate (a percentage) and time periods in determining NPV.

Interest Rates and Time Periods in Discounting

The size of the discounting effect depends on two things: the amount of time between now and each future payment (the number of discounting periods) and an interest rate called the discount rate. The example shows that:

- As the number of discounting periods between now and the cash arrival increases, the present value decreases.

- As the discount rate (interest rate) in the "present value" calculations increases, the present value decreases.

Whether you will or will not calculate present values yourself, your ability to use and interpret NPV / DCF figures will benefit from a simple understanding of the way that interest rates and discounting periods work together to create DCF. If you

Many if not most business people outside of finance, are unfamiliar with "time value of money" terms and calculations. The subject becomes approachable, however, if the explanation begins by noting that DCF mathematics are very closely related to that is familiar to most people:calculations for interest growth and compounding.

Remember briefly how interest calculations work. The FV formula looks into the future and might ask, for instance: What is the future value (FV) in one year, of $100 invested today (the PV), at an annual interest rate of 5%?

FV1 = $100 ( 1 + 0.05)1 = $105

When the FV is more than one period into the future, as most people know, interest compounding takes place. Interest earned in earlier periods begins to "earn interest on itself," in addition to interest on the original PV. Compound interest growth is delivered by the exponent in the FV formula, showing the number of periods. What is the future value in five years of $100 invested today at an annual interest rate of 5%?.

FV5 = $100 ( 1 + 0.05)5 = $128

The same formula can be rearranged to deliver a "present value" given a "future value" and "interest rate" for input, as shown.

Now, the formula starts in the future and looks backward in time, toward today.

The formula now asks: What is the value today of a $100 payment arriving in one year, using a discount rate of 5%?

PV1 = ($100) / (1.0 + 0.05)1

= $100 / (1.05)

= $95

You should be able to see why PV will decrease if we either (a) increase the interest rate, or (b) increase the number of periods before the FV arrives. What is the present value of $100 we will receive in 5 years, using a 5% discount rate?

PV5 = $100 / (1.0 +0.05)5

= $100 / (1.276)

= $75.13

When the FV is more than one period into the future, as most people know, interest compounding takes place. Interest earned in earlier periods begins to compound, in addition to interest on the original PV. Compound interest growth is delivered by the exponent in the FV formula, showing the number of periods. What is the future value in five years of $100 invested today at an annual interest rate of 5%?.

FV5 = $100 ( 1 + 0.05)5

= $128

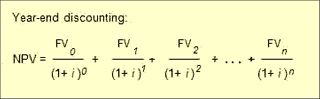

When discounting is applied to a series of cash flow events, a cash flow stream, as illustrated in the graph example above, net present value for the stream is the sum of PVs for each FV:

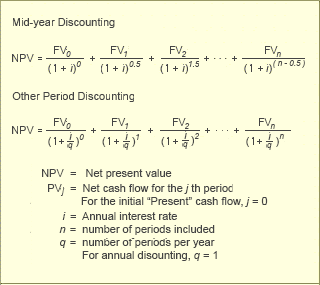

Should You Use Mid-Period (or Mid-Year) Discounting? What Difference Does it Make?

Finally, note two commonly used variations on the examples shown thus far. The cases above and most textbooks present first the "Period-end" (or "Year-end") discounting. Period-end discounting is the more frequently used DCF approach. The approach, moreover, usually turns up as the default approach for spreadsheet and calculator DCF functions.

Period-End Discounting

With the period-end approach, discounting works as though all cash flow occurs on the last day of each period. When periods are one year in length, of course, analysts call this the year-end approach. With year-end discounting, all of the period's cash flow is assumed to occur on day 365 of the year.

Mid-Period Discounting

Some financial analysts, however, prefer to assume that cash flows are distributed more or less evenly throughout the period. For them, discounting should, therefore, be applied when the cash flows during the period. Calculating present values this way is mathematically equivalent to saying that all cash flow occurs at mid-period. For this reason, this approach is called mid-period discounting. And, of course, the name mid-year discounting applies when periods are one year in length.

What Are the Differences Between the Two Approaches?

- Period-end discounting is more severe (has a more substantial discount effect) than the mid-period approach. Period-end calculations are more severe than mid-period versions because they impact all of the period's cash flow for the full period. You can see how this works mathematically from the formulas in the next section. The period-end approach divides each FV value by a more substantial discount factor than do mid-period calculations.

Some analysts prefer to describe the difference between approaches by saying the "period-end" discounting is the more conservative approach. - Those preferring the other approach say that discounting mid-period is more accurate.

Remember that the discount rate recognizes the values of opportunity, risk, and inflation—values that can change as time passes. Mid-period discounting comes closer, they say, to applying the discounting effect precisely when cash flows.

Formulas for Mid-Period Discounting

The methods below show NPV calculations for the mid-year approach (at panel top) and for discounting with periods other than one year (at mid-panel).

In any case, the business analyst will want to find out which of the above discount methods is preferred by the organization's financial specialists, and why, and follow their practice (unless there is justification for doing otherwise).

Choosing a Discount (Interest) Rate for Cash Flow Analysis

The analyst will also want to find out from the organization's financial specialists which discount rate the organization uses for discounted cash flow analysis. Financial officers who have been with an organization for some time, usually develop good reasons for choosing one discount rate or another as the most appropriate rate for the organization.

- In private industry, many companies use their own cost of capital (or a weighted average cost of capital) as the preferred discount rate.

- Government organizations typically prescribe a discount rate for use in the organization's planning and decision support calculations. In the United States, for instance, the Office of Management and Budget (OMB) publishes a quarterly circular with prescribed discount rates for Federal Government use.

- Financial officers may use a higher discount rate for investments or decisions viewed as risky, and a lower discount rate when expected returns from a proposed action come with less risk. The higher "discount rate" is a hedge against risk, because it puts relatively more emphasis (weight) on near-term returns compared to distant future returns.

Comparing Competing Investment Proposals with DCF and NPV

Consider two competing investments in computer equipment. Each calls for an initial cash outlay of $100, and each returns $200 over the next five years making for a net gain of $100. But the timing of the returns is different, as shown in the table below (Case Alpha and Case Beta), and therefore the present value of each year's gains is different. The sum of each investment's "present values" is called the discounted cash flow (DCF) or "net present value" (NPV). Using a 10% discount rate again, we find:

Timing | CASE Alpha | CASE Beta | ||

|---|---|---|---|---|

| Net Cash Flow | "Present Value" | Net Cash Flow | "Present Value" | |

| Now | – $100.00 | – $100.00 | – $100.00 | – $100.00 |

| Year 1 | $60.00 | $54.54 | $20.00 | $18.18 |

| Year 2 | $60.00 | $49.59 | $20.00 | $16.52 |

| Year 3 | $40.00 | $30.05 | $40.00 | $30.05 |

| Year 4 | $20.00 | $13.70 | $60.00 | $41.10 |

| Year 5 | $20.00 | $12.42 | $60.00 | $37.27 |

| Total | Net CFA = $100.00 | NPVA = $60.30 | Net CFB = $100.00 | NPVB = $43.12 |

Comparing the two investments, the larger the early returns in Case Alpha lead to a better net present value (NPV) than the later large return in Case Beta. Note especially the Total line for each present value column in the table. This total is the net present value (NPV) of each cash flow stream." When choosing alternative investments or actions, other things being equal, the one with the higher NPV is a better investment.

What Roles Do DCF and NPV Play in Business Case Analysis?

In brief, an NPV / DCF view of the cash flow stream should probably appear with a business case summary when:

- The business case deals with an "investment" scenario of any kind, to compare different uses for funds.

- The business case covers a long period (two or more years).

- Inflows and outflows change differently over time. For example, the most substantial "inflows" come at a different time from the most substantial "outflows."

- Two or more alternative cases for comparison differ concerning cash flow timing within the analysis period.

D. XO Net Present Value (NPV) as a Capital Budgeting Method

What is net present value and how is it used in capital budgeting?

Companies often use net present value as a capital budgeting method because it's perhaps the most insightful and useful method to evaluate whether to invest in a new capital project. It is more refined from both a mathematical and time-value-of-money point of view than either the payback period or discounted payback period methods. It is also more insightful in certain ways than the profitability index or internal rate of return calculations.

What Is Net Present Value?

Net present value is one of many capital budgeting methods used to evaluate potential physical asset projects in which a company might want to invest. Usually, these capital investment projects are large in terms of scope and money, such as purchasing an expensive set of assembly-line equipment or constructing a new building.

Net present value uses discounted cash flows in the analysis, which makes the net present value more precise than of any of the capital budgeting methods as it considers both the risk and time variables.

A net present value analysis involves several variables and assumptions and evaluates the cash flows forecasted to be delivered by a project by discounting them back to the present using information that includes the time span of the project (t) and the firm's weighted average cost of capital (i). If the result is positive, then the firm should invest in the project. If negative, the firm should not invest in the project.

Capital Projects Using Net Present Value

Before you can use net present value to evaluate a capital investment project, you'll need to know if that project is a mutually exclusive or independent project. Independent projects are those not affected by the cash flows of other projects.

Mutually exclusive projects, however, are different. If two projects are mutually exclusive, it means there are two ways of accomplishing the same result. It might be that a business has requested bids on a project and a number of bids have been received. You wouldn't want to accept two bids for the same project. That is an example of a mutually exclusive project.

When you are evaluating two capital investment projects, you have to evaluate whether they are independent or mutually exclusive and make an accept-or-reject decision with that in mind.

Net Present Value Decision Rules

Every capital budgeting method has a set of decision rules. For example, the payback period method's decision rule is that you accept the project if it pays back its initial investment within a given period of time. The same decision rule holds true for the discounted payback period method.

Net present value also has its own decision rules, which include the following:

- Independent projects: If NPV is greater than $0, accept the project.

- Mutually exclusive projects: If the NPV of one project is greater than the NPV of the other project, accept the project with the higher NPV. If both projects have a negative NPV, reject both projects.

Example: Calculation of Net Present Value

Say that firm XYZ Inc. is considering two projects, Project A and Project B, and wants to calculate the NPV for each project.

- Project A is a four-year project with the following cash flows in each of the four years: $5,000, $4,000, $3,000, $1,000.

- Project B is also a four-year project with the following cash flows in each of the four years: $1,000, $3,000, $4,000, $6,750.

- The firm's cost of capital is 10 percent for each project, and the initial investment is $10,000.

The firm wants to determine and compare the net present value of these cash flows for both projects. Each project has uneven cash flows. In other words, the cash flows are not annuities.

Following is the basic equation for calculating the present value of cash flows, NPV(p), when cash flows differ each period:

NPV(p) = CF(0) + CF(1)/(1 + i)t + CF(2)/(1 + i)t + CF(3)/(1 + i)t + CF(4)/(1 + i)t

Where:

- i = firm's cost of capital

- t = the year in which the cash flow is received

- CF(0) = initial investment

To work the NPV formula:

- Add the cash flow from Year 0, which is the initial investment in the project, to the rest of the project cash flows.

- The initial investment is a cash outflow, so it is a negative number. In this example, the cash flows for each project for years 1 through 4 are all positive numbers.

Tip: You can extend this equation for as many time periods as the project lasts.

To calculate the NPV for Project A:

NPV(A) = (-$10,000) + $5,000/(1.10)1 + $4,000/(1.10)2 + $3,000/(1.10)3 + $1,000/(1.10)4

= $788.20

The NPV of Project A is $788.20, which means that if the firm invests in the project, it adds $788.20 in value to the firm's worth.

NPV Disadvantages

Although NPV offers insight and a useful way to quantify a project's value and potential profit contribution, it does have its drawbacks. Since no analyst has a crystal ball, every capital budgeting method suffers from the risk of incorrectly estimated critical formula inputs and assumptions, as well as unexpected or unforeseen events that can affect a project's costs and cash flows.

The NPV calculation relies on estimated costs, an estimated discount rate, and estimated projected return. It also can't factor in unforeseen expenses, time delays, and any other issues that come up on the front or back end, or during the project.

Also, the discount rate and cash flows used in an NPV calculation often don't capture all of the potential risks, assuming instead the maximum cash flow values for each period of the project. This leads to a false sense of confidence for investors, and firms often run different NPV scenarios using conservative, aggressive, and most-likely sets of assumptions to help mitigate this risk.

Alternative Evaluation Methods

In some cases, especially for short-term projects, simpler methods of evaluation make sense. The payback-period method calculates how long it will take to earn back the project's initial investment. Although it doesn't consider profits that come in once the initial costs are paid back, the decision process might not need this component of the analysis. The method only makes sense for short-term projects because it doesn't consider the time value of money, which renders it less effective for multiyear projects or inflationary environments.

The internal rate of return (IRR) analysis is another often-used option, although it relies on the same NPV formula. IRR analysis differs in that it considers only the cash flows for each period and disregards the initial investment. Additionally, the result is derived by solving for the discount rate, rather than plugging in an estimated rate as with the NPV formula.

The IRR formula result is on an annualized basis, which makes it easier to compare different projects. The NPV formula, on the other hand, gives a result that considers all years of the project together, whether one, three, or more, making it difficult to compare to other projects with different time frames.

D. XO Aspect NPV on The Next-generation digital payment technology

Use Due Cash payment system with anyone

You can make, share, or receive payments from anyone in the U.S. who has a phone number or email account regardless if they are actually using the Due Cash payment system and digital wallet. All they need to do is create a Due account to claim or make their payment. Find others you know with a Due account simply by syncing your smartphone contacts.

Our next-generation digital payment technology guards against any type of unauthorized transaction. If you believe that there has been unauthorized activity on your Due digital wallet .

Our next-generation digital payment technology guards against any type of unauthorized transaction. If you believe that there has been unauthorized activity on your Due digital wallet .  If you have lost your phone or believe it is being used in an unauthorized way, you can protect your Due digital wallet by visiting Passwords & Authorizations within your online account settings. Here, you can revoke access from your phone so it will log out of any active sessions within your Due digital wallet.

If you have lost your phone or believe it is being used in an unauthorized way, you can protect your Due digital wallet by visiting Passwords & Authorizations within your online account settings. Here, you can revoke access from your phone so it will log out of any active sessions within your Due digital wallet.  Only use your Due digital wallet and eCash payment system with people you know. We don’t permit merchants to make sales via Due or offer buyer or seller protection.

Only use your Due digital wallet and eCash payment system with people you know. We don’t permit merchants to make sales via Due or offer buyer or seller protection. E-CASH INDUSTRY

The advancement of technology has helped electronic payments grow significantly. For example, in 1968 the exchanging of electronic data became commonplace for anyone looking to transfer money. In 1974, Robert Moreno patented technology for smart cards, which was followed by the first ATMs in the United States.

Before the decade was over, electronic terminals called, “EFTPOS” (meaning, for non-cash bank payments) were being used in the United States. Five short years later in 1984, email was being used by enterprises everywhere in the financial sector to communicate with customers.

Cash without acknowledging the release of the first PC by IBM in 1981. The PC made it possible to develop microelectronics, which would quickly allow for microprocessors to be installed in a credit card.

David Chaum, a U.S. citizen and brilliant mathematician, became the head of cryptography at the Dutch national research center CWI. Dr. Chaum was responsible for the invention of secure digital cash, along with the idea of blind signatures for untraceable payments. This resulted in the founding of the first electronic payment system in the world, DigiCash. Unfortunately, DigiCash went bankrupt in 1998 and sold its assets to eCash Technologies. However, DigiCash had already left an impact everywhere in the eCash world. At one American bank, the customers had already embraced the eCash idea, with 90% of its depositors using the system.

At the “Real World Crypto” conference held at Stanford University January 6, 2016, Chaum was back with information on a new plan for encryption, called PrivaTegrity which he is working on with a whole team of experts from other universities. This group of academic partners hopes to allow a system that will fully allow secret and anonymous communication, including eCash capabilities, to be totally secure and be fast enough to work as a smartphone app. It is unknown if the project is fully coded and tested. Particularly compelling was Dr. Chaum’s claim that we may be able to have a “civil society electronically without the possibility of covert mass surveillance.”

Dr. Chaum’s DigiCash wasn’t the only company exploring the electronic cash industry .

The 2000’s saw impressive gains in the use and acceptance of eCash as a result of advances in technology. Some of the most notable occurrences have been:

- Bitcoin, a digital asset and a payment system, was invented in 2009.

- Google’s mobile payment system, Google Wallet, is released in 2011.

- Following in the steps of Google, Apple, Android, and Samsung release mobile payment and digital wallets services in 2014 and 2015.

- The United States makes the switch to EMV cards – which stands for Europay, MasterCard, and Visa – in 2016.

HOW DOES ECASH WORK?

How exactly does eCash work? To have a better understanding, let’s first familiarize ourselves with how money traditionally flows using eCash.

- Withdrawal. Users have the ability to convert money from their eCash accounts into eCash coins. However, access can only be granted to the eCash account if the user can sign the withdrawal request. The signature is checked against the public key that has been registered with the ecash account since the coins are accessed using a password-encryption.

- Payment. In order to pay a specified amount, a set of coins that equal the desired amount must be selected. If you were using the on-line ecash system, the set of coins would be encrypted for the bank through the bank’s unique public key. The shop then deposits the payment at their bank, who then credits the merchant’s eCash account, as long as all coins are valid. The accepted coins are added to the database of spent coins to prevent them from being spent again.

- Payment deposit. Again, using the on-line ecash system, this protocol would be completed by the shop or merchant. The most important component of the payment protocol is that the payment deposit will be made specifically to the payee.

- Coin redemption. Coins can be directly returned to the mint without using them in a payment if they’ve expired, need to be refreshed, or need improved distributions.

- Recovery. If coins that have been lost they can be recovered through a protocol carried out between the user and the mint.

Now that we’re aware of how the money flows, it’s time to realize that the money flow can only be accomplished through the cooperation of the following four components:

- Issuers. These can either be financial institutions, or non-bank institutions.

- Customers. These are the individuals who spend eCash.

- Merchants or traders. These are the vendors who receive eCash.

- Regulators. Authorities or state tax agencies.

Once all of the parties are involved, the basic idea of an eCash transaction involves at least one of the components; the issuer, customer, and merchant who will accept the eCash in exchange for the products or services rendered. There are then three general stages for the transaction to be completed.

Account Setup

The Consumer has to open an account with a bank that provides eCash accounts. The merchant who is willing to participate in eCash transactions must have access to these accounts with a number of banks in order to support the transaction of the consumer who may use any of these various bank accounts. However, the banks will manage both the consumers’ and merchants’ accounts.

Purchase

Once the consumer decides to purchase a good or service, he or she will transfer the eCash amount from their bank account to either their electronic purse (on-line system) or eCash token (off-line system). The eCash payment will then be transferred to the merchant so that they are compensated for the goods or services provided. The eCash payment will be either a softcopy (via software) or token based. For most transactions through the Internet, the process will be encrypted.

Authentication

After receiving the electronic payment from the consumer, the merchant will receive a confirmation from the bank. The bank will then authenticate the electronic transaction. During this same step, the bank will debit the consumer’s account for the amount that was agreed upon. Finally, the merchant delivers the products or services and will inform the bank to deposit the payment into their bank account.

Although these stages may sound complicated if you’re new to eCash, digital cash actually acts very similarly to physical cash. The obvious difference is that electronic is digital. Here’s an example of how an eCash system would work:

A bank creates a unique digital bank note that includes a message which issues a serial number (with a primary or public key) and value of the note. This is sent to Person A. Whenever Person A withdraws this note, it will use Chaum’s Cryptographic technique. This will alter the serial number. As a result, the bank will not recognize the note when it is withdrawn. The note will be returned to the bank with a new serial number.

Person A will then pay Person B electronically by sending the bank note to him or her. Person B will check the note’s validity by decrypting it through the bank’s public key to check its signature, a.k.a. the new serial numbers validity. Person B ships the note off to the bank, which checks the serial number to confirm that this specific bank note has never been spent before. The serial number, which is different from the note number that was withdrawn by Person A, will prevent the bank from linking the two transactions.

The final phase includes the enabling bank checking the new serialized key account for the amount of the transaction. If validated, the amount will be transferred via a depository notice. Person B, who is using the same encrypting technique, will return the depository notice with the new serialize account. Again, the enabling bank will be aware of who the merchant is. The bank will only know that that money is available and can be used as a payment.

In other words, think of this eCash transaction as a debit card transaction except that there is no other information besides the amount of the transaction, making the process secure.

WHAT IS CRYPTOCURRENCY AND HOW IS IT OBTAINED?

You simply can’t have a discussion involving eCash and not mention cryptocurrency. Ever since Bitcoin launched in 2009, the cryptocurrency has captured the minds of lawmakers, financial institutions, and the general public as a whole. But, what exactly is cryptocurrency and how can it be obtained.

Cryptocurrency Explained

In it’s simplest form, cryptocurrency is a digital or virtual currency that uses cryptography for security purposes to prevent counterfeit. Cryptography, for those who are unaware, means the science of coding and decoding messages so that they remain secure. During the coding process, a key is used which is known to only the sender and the recipient.

What makes cryptocurrency unique is that it is not issued by any type of authority figure, such as a central bank. Because of this, cryptocurrency is in theory, immune to interference from bodies of government. Another feature that cryptocurrency is known for is that users can remain anonymous. The issue with anonymity is that it can be used for illegal activity like money laundering and tax evasion.

In most cases, cryptocurrency works simply when two parties transfer funds between each other. Since this involves cryptography, either a public or private keys like an RSA signature must be used to complete the transaction. Each transaction is recorded on a public ledger, also called either a distributed ledger or a blockchain, that is visible to anyone in the network. Personal information is not shared, though.

Besides security and anonymity, cryptocurrency is appealing to users because there are only minimal processing fees, as opposed to the expensive fees that most banks and financial institutions charge for transfers.

The major concern involving cryptocurrency is that because it’s a virtual or digital currency, an individual’s balance can be erased if there is a security breach or computer crash. In most instances, however, this information can be easily backed-up on the cloud. Finally, the price of cryptocurrencies is that the value can fluctuate sporadically.

A Quick Word Regarding Bitcoin

While the idea behind cryptocurrency existed years before, cryptocurrency came to the forefront in 2009 when Bitcoin was released. Bitcoin was created by a computer programmer going by the pseudonym Satoshi Nakamoto. Bitcoin is an open-source, peer-to-peer digital currency that is completely decentralized. Today, Bitcoin is accepted by more than 6,000 companies that include Overstock and Virgin Galactic.

As explained by the Congressional Research Service, “Like the U.S. dollar, the Bitcoin has no intrinsic value in that it is not redeemable for some amount of another commodity, such as an ounce of gold. Unlike a dollar, a Bitcoin has no physical form, is not legal tender, and is not backed by any government or any other legal entity, and its supply is not determined by a central bank.” (In part of this Congressional Research Service report it states that the dollar is a legal currency, yet doesn’t specifically say the Bitcoin isn’t legal, it just eludes that it isn’t traceable, and therefore a concern to governments.)

Through cryptographic techniques “special users on the bitcoin network, known as miners, to gather together blocks of new transactions and compete to verify that the transactions are valid—that the buyer has the amount of Bitcoin being spent and has transferred that amount to the seller’s account. For providing this service, miners that successfully verify a block of transactions are rewarded by the network’s controlling computer algorithm with 25 newly created Bitcoins.”

How to Obtain Cryptocurrency

Whether it’s Bitcoin or one of the hundreds of alternatives on the crypto-current market, (called Altcoins, meaning an alternate cryptocurrencies – which basically means an alternative to Bitcoin) you must first download the free and open-source software. After that, there are two basic ways to obtain cryptocurrencies, according to Forbes; “mine them using a powerful computer and buy them through a crypto exchange.”

Mining Bitcoins and Altcoins, as described in PCWorld, “involves writing a short script to run in the command prompt. It’s only a few steps, which you must follow exactly to ensure success.” However, this can put a lot of stress on your computer because it must “solve complex problems that keep the respective cryptocurrency’s peer-to-peer infrastructure secure.” In exchange for their work, miners are given pieces of Bitcoins.

If you prefer to purchase Bitcoins or Altcoins, you can only do so through select and limited markets. This includes currencies on major exchanges like VaultofSatoshi, Kraken, Coinex, and BTC-e.

What makes cryptocurrencies like Bitcoin interesting is that they can be used as an investment tool and a transactional platform.

PROPERTIES OF ECASH

For electronic payments to be as effective and efficient as paper and coin currency, electronic payments should include the following properties:

Security

One of the main concerns surrounding eCash is how secure it is. When the determined amount is being transferred between consumers, merchants, and banks the prevention of any unauthorized individuals like hackers intercepting, or even changing, the content of the messages, such as the dollar amount, should be addressed. This is commonly addressed through encryption and special serial numbers that give the bank the power to verify the authenticity of the transaction.

Besides online security, physical security should be taken into account. For example, if a hard drive crashes or a smart card is stolen, the eCash could also be lost. Thanks to advances in technology, eCash can be stored on secure cloud databases so that it can be easily recovered.

Privacy

Privacy, in regards to eCash, is the anonymity of the consumers who have made the payment. As with coins and paper notes, the payee should not be able to be linked or be traced during transactions. Privacy is important because consumers’ privacy should be protected from being monitored by financial surveillance. Anonymity, however, does present a number of concerns like counterfeiting, money laundering, and blackmailing in extreme circumstances. Keep in mind that the more anonymity that is offered the less security there will be.

Portability

One of the benefits of electronic cash is that it’s portable and can be taken with you no matter where you are in the world. In fact, the portability of eCash could replace traditional wallets since it can be stored on your smartphone on in the cloud.

Transferability

Another advantage of eCash is that it can be transferred from the payee to the payer without being referred to a bank. The ability to transfer between parties should be easy and convenient, just as with traditional paper and coins. Parties should also be able to exchange funds electronically to each other no matter where they are in the world.

Divisibility

When discussing divisibility, eCash denominations should be able to be divided into small amounts. This makes smaller transactions possible between parties. Arguably on the main challenges for divisible systems having the ability to divide the value into smaller amounts that will eventually be equal to the original value.

Previously, divisibility systems were solved by Eng, and Okamoto’s scheme, Okamoto’s scheme and Okamoto and Ohta’s scheme. More recently, International Association for Cryptologic Research shared a system by Patrick Märtens that is based on bounded accumulators and “a new technique to prove that several revealed values are inside an accumulator.”

As a whole, eCash payments do not just have to contain the features listed above. To truly replace traditional money transfers, electronic payments have to be more convenient, easier-to-use, and ubiquitous – meaning that eCash networks must work with each other.

ECASH SYSTEMS

It’s common practice for eCash systems like PayPal, eCash, WebMoney, and Payoneer to sell their electronic currency directly to the end user. However, it’s not uncommon for other systems to sell their currency through third-party digital currency exchangers. For example, the M-Pesa system transfers money via mobile devices in third world countries like Africa, India, Afghanistan, and Eastern Europe. In some situations, community currencies, such as local exchange trading systems (LETS) and the Community Exchange System, work with electronic transactions.

In the above examples, these systems are known as centralized systems where the user’s real identity is still known. This has raised privacy concerns over centralized systems, however, it has also been argued that being able to identify users is a benefit if they need to be contacted or identified.

Decentralized Systems

You can’t talk about decentralized systems without discussing how cryptocurrencies play a part in these systems. Cryptocurrencies, as noted previously, are not regulated by any governing body that can verify the peer-to-peer transaction, which occurs anonymously. Because these systems are decentralized, the value of the currency can fluctuate quickly and often.

Besides Bitcoin, are here some other examples of cryptocurrencies that use decentralized systems:

- Monero launched in 2014 and “is built on principles of privacy, decentralization, and scalability.”

- Litecoin was founded in 2011, Litecoin is “a peer-to-peer Internet currency that enables instant, near-zero cost payments to anyone in the world.”

- Dogecoin is an open-source peer-to-peer currency that allows you to easily send money online.

- Peercoin claims that it’s more energy efficient and the world’s first proof-of-stake coin that was created in 2012.

- Primecoin is an innovative cryptocurrency that uses as “unique form of proof-of-work based on prime numbers.”

- Ripple doesn’t rely on the Bitcoin code and focuses on improving cross-border payment offerings.

- Nxt also uses its own code that was developed from scratch.

Contactless Payment Systems

These are credit cards, debit cards, smart cards, or mobile devices that rely on radio-frequency identification (RFID) or near field communication (NFC) to make secure transactions that do not require signature or PIN verification. The most common examples are contactless payment systems are mobile subsystems and digital wallets. Examples include:

- The ‘electronic purse’ that was introduced by Mondex and National Westminster Bank in 1994.

- The payment system called Mobipay that was implemented by Telefónica and BBVA Bank in Spain in 2005.

- Venmo originally launched as a mobile payment system through SMS in 2010. It became a social app where friends could pay for small purchases like a cup of coffee.

- Google Wallet, which launched on September 19, 2011, allows users to store all of their credit card and debit card online.

- Easytrip was initiated in 2012 in Ireland as a way to pay road tolls. The tolls were charged to the user’s mobile phone account or prepaid credit.

- The O2 Wallet was introduced in 2012 and could be loaded with regular bank accounts or cards. The service shut down in 2014.

- In October 2014 Apple Pay was released and is similar to Google Wallet, except it’s exclusive to iPhone users.

- Samsung Pay debuted in 2015 to rival Apple Pay. It has similar features but is available for Samsung devices.

- GNU Taler is an anonymous and open source electronic payment system that will be available to the public in 2016.

THE BENEFITS OF ECASH

The greatest benefit with eCash is that allows individuals to make financial transactions online in real-time. Because financial information is stored electronically, consumers no longer have to carry cash, only mobile devices or smart cards to complete a transaction. eCash also gives merchants more opportunities to partake in commerce.

Those are a just a few of the benefits of eCash. Here’s a closer look at the advantages that users and merchants can enjoy.

Users

Instead of waiting for a bank to approve a transaction, such as for a check to clear, users can send and exchange funds instantly without ever having to step inside of a bank. In fact, you can use electronic payment systems anywhere in the world, as long as you can get online. Furthermore, eCash prevents consumers from having to pay withdrawal fees that are commonly by banks whenever you visit the ATM or the interest rates that incur with credit cards. In fact, people can exchange money directly to each other without the involvement of a third party.

Merchants

Merchants also have a lot to gain by embracing eCash systems. For starters, these systems can become a marketing tool for their eCommerce business. When a merchant uses a payment system, whether it’s PayPal, Apple Pay, or Primecoin, the consumer can feel secure in making a purchase of the site since the online marketplace uses a trusted payment system. Some payment systems also provide merchants with coupons to help entice consumers. Another perk is that the fees charged by eCash payment systems are usually lower than what credit card companies charge.

eCash also gives merchants from anywhere in the world to partake in the global marketplace. For example, an online merchant in India can sell their products to anyone in the world and accept payments with just one-click of a button. Family members in Uganda can exchange funds between each other, even if none of them have a traditional bank account.

Finally, both merchants and customers can enjoy the security, and if needed the anonymity, that eCash provides. Since each transaction still needs to be verified, the chances of fraud are greatly reduced.

International Exchange

This was touched upon earlier, but one of the greatest advantages of eCash is that it’s going to increase the opportunities for international exchange. No matter where you live in the world, you can sell your product to international consumers and receive a payment in real-time. For example, you could be a record shop in Germany that sells a $20 vinyl to a customer in Australia or a clothing manufacturer in America who sells products to customers in Brazil for $15 a shirt. Not only are the fees cheaper, it makes it easier to sell items to a global marketplace by using a fast, secure, and convenient eCash system.

DISADVANTAGES OF ECASH

While electronic payment systems have been improving their security features, this is one area that remains a concern for users and merchants. Despite needing to verify transactions, fraud is still a common occurrence, thanks to hackers. For example, a hacker can find their way into the bank accounts of unsuspecting victims which could lead to instances of identity theft or having your funds stripped away. Hackers could also attempt to counterfeit the money by recreating the eCash form.

Additionally, there is a concern that eCash can become easily available to criminal and terrorist groups if they use a decentralized system. This makes it harder for governments to track these types of organizations since it’s more difficult to find a paper trail. eCash also makes it more challenging to monitor and collect both income and taxes, so it’s possible for people to easily transfer funds and hide assets in offshore accounts.

One of the troubling limitations of eCash is that while it has the chance to be used by low-income individuals or those in undeveloped countries, it will be an uphill battle for these groups to use an eCash system since a computer, mobile device, and internet connection are required for eCash transactions. Until this problem is addressed, which is an area that organizations like the Bill and Melinda Gates Foundation are working on, not everyone can enjoy the benefits of eCash.

Finally, there are concerns about what happens when you can’t access your funds, such as during a power failure. Or, what happens when your records or coins are lost because of a security breach. These are rare occurrences and have been considered as more and more information is stored in the cloud.

ECASH REGULATIONS

In 1996, Patrick G. Goshtigian discussed the regulations of eCash in a paper published at the Anderson Graduate School of Management at UCLA. In regards to security, Goshtigian stated;

“The legal challenges of E-cash entail concerns over taxes and currency issuers. In addition, consumer liability from bank cards will also have to be addressed (currently $50 for credit cards). E-cash removes the intermediary from currency transactions, but this also removes much of the regulation of the currency in the current system.

Tax questions immediately arise as to how to prevent tax evasion at the income or consumption level. If cash-like transactions become easier and less costly, monitoring this potential underground economy may be extremely difficult, if not impossible, for the IRS.

The more daunting legal problem is controlling a potential explosion of private currencies. Large institutions that are handling many transactions may issue electronic money in their own currency. The currency would not be backed by the full faith of the United States, but by the full faith of the institution. This is not a problem with paper currency, but until the legal system catches up with the digital world, it may present a problem with cybercash.”

For over twenty years we are still facing numerous legal questions surrounding eCash since it not only can cross borders but also because it’s difficult to track. These issues, especially the governmental oversight of currencies, will continue to be an issue with eCash use.

To have a better understanding of the laws and regulations regarding eCash, here are how several different countries are handling cryptocurrencies like Bitcoin:

The United States

Bitcoin is legal in the United States and was classified as a convertible decentralized virtual currency by the U.S. Treasury in 2013. In 2015, the Commodity Futures Trading Commission, CFTC, started to classify Bitcoins as a commodity. Currently, New York state is the only state to have granted a license to a Bitcoin exchange in 2015. The company, itBit, now has a bank-like status in the U.S.

Canada

According to the Library of Congress, “Canada does not have a specific law or regulation that regulates bitcoins.” However, Bitcoin is not considered legal tender in Canada and has been briefly mentioned during anti-money laundering and anti-terrorist financing regulations for virtual currencies.

Germany

Germany considers Bitcoins like foreign currency. While not recognized as legal tender, Bitcoins “are units of value that have the function of private means of payment within private trading exchanges, or they are substitute currencies that are used as a means of payment in multilateral trading transactions on the basis of legal agreements of private law. ”

The United Kingdom

While Bitcoins are not regulated in the UK, it’s been reported that “Her Majesty’s Revenue and Customs has classed bitcoins as “single purpose vouchers,” rendering any sales of them liable to a value-added tax of 10–20%.”

Japan

As of this writing, Japan has no laws regarding the use of Bitcoins. Haruhiko Kuroda, the governor of the Bank of Japan (BOJ), has said that the BOJ was “researching issues of bitcoins, but I have nothing to say regarding bitcoins at the moment.”

China

China is one of the few countries in the world where Bitcoins are essentially illegal. In fact, the country announced the “Notice on Precautions Against the Risks of Bitcoins,” in 2013 stating that it prohibits banking and payment institutions from dealing in Bitcoins.

India

While there doesn’t appear to be any legal framework that regulates, restricts, or bans the use of Bitcoins in India, the country’s banking institutions have warned customers about the potential hazards that Bitcoin can present. This was most evident with the 2013 release of the Reserve Bank of India’s public notice.

Russia

Bitcoin is currently in dispute in Russia. In 2014, Legislation was introduced by the Ministry of Finance that would view Bitcoin transactions as a misdemeanor and would impose fines for dealing with cyber currencies and monetary surrogates.

Brazil

As noted by the Library of Congress, “On October 9, 2013, Brazil enacted Law No. 12,865, which created the possibility for the normalization of mobile payment systems and the creation of electronic currencies, including the Bitcoin. The Law provides, among other things, for the payment arrangements and payment institutions that comprise the Brazilian Payment System.”

Overall, most central banks across the world are cautioning individuals from using virtual currencies like Bitcoin. In most cases though, most authorities are allowing citizens to use virtual currencies, even though they’re not accepted as legal tender.

THE FUTURE OF ECASH

THE FUTURE OF ECASH

Jerry Kuch, Yacov Yacobi, and Paul England, cryptography researchers at Microsoft, proclaimed that eCash will be the future of money. According to these researchers “we’ll carry little cards with computer chips called e-wallets and exchange encrypted bits of information for things we need.” They also predicted that we’ll be able to:

- Make one-click micro-payments online.

- Have anonymous payments online.

- Use non-traditional devices like a smartphone to make payments.

Does any of this sound familiar? It should. Because those predictions have already come to fruition to make this an exciting time for electronic payments. But, where are we headed next?

Dan Schutzer, Senior Technology Consultant, BITS, believes that the future of digital cash could go in four different directions:

- Digital cash would be replaced by an alternative, such as a pre-paid or debit card, or a new start-up payment processor that meets the security and privacy needs of customers.

- Digital cash will continue to grow and may even get embraced by governments and banks. This could already be in happening. In 2012 the MintChip was introduced by the Royal Canadian Mint. The chip was attached to SD cards and contained a private key that was signed by the mint.

- Digital cash will only exist in niche markets, similar to how PayPal started because it was the preferred payment gateway for eBay users.

- Bitcoin and other blockchain alternatives will be replaced by improved financial platforms.

For the purpose of this guide, this is where we expect eCash will bring to the future of the payments industry.

Bitcoin Will Be Replaced By the Blockchain

One interesting development that has occurred is the work that IBM has contributed to the blockchain that could have serious implications. In March 2012. Reuters reported that IBM was working on a way to create a digital cash and payment system for major currencies. While this would use the blockchain idea, the “transactions would be in an open ledger of a specific country’s currency such as the dollar or euro.”

In December 2015, this became a reality when it announced that the Open Ledger Project had been created. This new blockchain was supported by IBM, Intel, JP Morgan, the Linux Foundation, and several big banks. As stated in Fortune, “The Open Ledger Project isn’t proposing another cryptocurrency, but rather it wants to use blockchain technology to create tools to allow businesses to build a distributed ledger for anything they can dream up–from exchanging automotive titles in seconds to paying retail suppliers when a sale is made.”

Because this new ledger is connected and distributed, the changes that have been made in the database will be easy to track, as well as be more difficult to forge. Currently, Honduras is using this technology to keep tabs on land titles and musicians are able to let fans pay them directly for their music.

There won’t be just one blockchain. There were be several versions that could bring an end to Bitcoin, primarily because these specific blockchains will be more exclusive. Unlike Bitcoin, which basically allows anyone in, the blockchain will be a part of a limited community.

Besides the Open Ledger Project, there are a number of innovative companies embracing the blockchain. Bitwage uses the blockchain to make international payroll cheaper. Voatz is aiming to make elections cheaper and more transparent through smartphones and the blockchain. And, Chronicled has merged RFID tags with the Blockchain in order to validate luxury goods which will curb counterfeit items.

Mobile Payments Will Go Mainstream

This shouldn’t come as a surprise. With more than 6 billion in the world having access to a mobile device, and that figure expected to grow, electronic payments via mobile devices will become more common. This will be accomplished with near-field communication. With NFC chips already installed in most mobile devices, the transfer of electronic payments is already taking place. Users simply have to download an app and will be able to transmit banking and payment data when placed near readers. And, unlike debit cards, mobile devices are capable of displaying the payment details in real-time.

Mobile devices, however, are only a part of the potential that NFC chips present. NFC chips can be installed in wearable devices, like a watch, wristband, or ring. Instead of using plastic or even pulling out our phones, we’ll be able to tap or swipe or use a wearable device to complete a purchase.

On top of NFC chips, the use of proximity beacons will enhance the growth of mobile payments. Companies will be able to target customers based on their location. For example, as a person approaches a store that they are already a customer of, the store will send you a coupon. The customer can then make the purchase through their mobile device and pick-up their item in swift motion.

The convenience of making electronic payments with your mobile device isn’t the only benefit. As noted in Forbes, “Ridding ourselves of cash will require new thinking on customer interaction, crime, value, and even cars.” For example, you could take the EZ Pass idea and apply that to drive-throughs at fast food restaurants where payments are collected from a device located on your vehicle.

Without cash registers and physical cash, the amount of robberies and pickpockets could be reduced. Governments could track how money is moved in real-time and use that information to solve problems like poverty. Check-out lines and transaction costs will also decrease.

Beyond the blockchain, mobile devices, and wearables, we may even experience digital currency exchanges by using biometrics. Companies like Apple and Samsung are already using fingerprints to verify transactions. But, don’t be surprised if someday soon people will have chips implanted in their hands that will contain payment information.

That’s not to say that cash will be completely eradicated. There may still always be a need for physical cash, however, digital cash will continue to evolve quickly.

E. XO NPV TO Object in What Is an E-payment System?

An e-payment system is a way of making transactions or paying for goods and services through an electronic medium, without the use of checks or cash. It’s also called an electronic payment system or online payment system. Read on to learn more.

The electronic payment system has grown increasingly over the last decades due to the growing spread of internet-based banking and shopping. As the world advances more with technology development, we can see the rise of electronic payment systems and payment processing devices. As these increase, improve, and provide ever more secure online payment transactions the percentage of check and cash transactions will decrease.

Electronic payment methods

One of the most popular payment forms online are credit and debit cards. Besides them, there are also alternative payment methods, such as bank transfers, electronic wallets, smart cards or bitcoin wallet (bitcoin is the most popular cryptocurrency).

E-payment methods could be classified into two areas, credit payment systems and cash payment systems.

1. Credit Payment System

- Credit Card — A form of the e-payment system which requires the use of the card issued by a financial institute to the cardholder for making payments online or through an electronic device, without the use of cash.

- E-wallet — A form of prepaid account that stores user’s financial data, like debit and credit card information to make an online transaction easier.

- Smart card — A plastic card with a microprocessor that can be loaded with funds to make transactions; also known as a chip card.

2. Cash Payment System

- Direct debit — A financial transaction in which the account holder instructs the bank to collect a specific amount of money from his account electronically to pay for goods or services.

- E-check — A digital version of an old paper check. It’s an electronic transfer of money from a bank account, usually checking account, without the use of the paper check.

- E-cash is a form of an electronic payment system, where a certain amount of money is stored on a client’s device and made accessible for online transactions.

- Stored-value card — A card with a certain amount of money that can be used to perform the transaction in the issuer store. A typical example of stored-value cards are gift cards.

Pros and cons of using an e-payment system

E-payment systems are made to facilitate the acceptance of electronic payments for online transactions. With the growing popularity of online shopping, e-payment systems became a must for online consumers — to make shopping and banking more convenient. It comes with many benefits, such as:

- Reaching more clients from all over the world, which results in more sales.

- More effective and efficient transactions — It’s because transactions are made in seconds

- without wasting customer’s time. It comes with speed and simplicity.

- Convenience. Customers can pay for items on an e-commerce website at anytime and anywhere. They just need an internet connected device. As simple as that!

- Lower transaction cost and decreased technology costs.

- Expenses control for customers, as they can always check their virtual account where they can find the transaction history.

- Today it’s easy to add payments to a website, so even a non-technical person may implement it in minutes and start processing online payments.

- Payment gateways and payment providers offer highly effective security and anti-fraud tools to make transactions reliable.

E-commerce, as well as m-commerce, is getting bigger year after year, so having an e-payment system in your online store is a must. It’s simple, fast and convenient, so why not have one?

Still, one of the most popular payment methods are credit and debit card payments, but people also choose some alternatives or local payment methods. If you run an online business, find out what your target audience needs and provide the most convenient and relevant e-payment system.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Examples NPV concept in Energy Industries

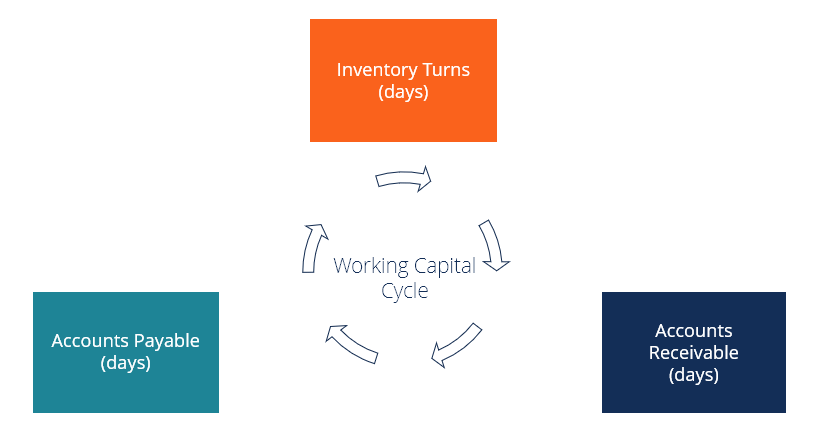

E.XO e- Money and working capital Turn Over

Working capital turnover ratio :

we examine the working capital turnover ratio. The working capital turnover ratio is an activity ratio that measures how many times working capital is used to generate sales, ie revenue, during a specific time period. As such, the ratio is a good indicator of company growth and liquidity and is calculated as follows:

The ratio is sometimes known as the capital turnover ratio, as net sales to working capital, or by the acronym WCTO.

Working capital is generally calculated as the company’s current assets less its current liabilities. Current assets include inventory and accounts receivable together with all other assets that will be held for less than 12 months. Current liabilities include accounts payable and payroll as well as any other liabilities, eg taxes, due in under a year.

Example

Company XYZ’s net sales year-to-date are €189,445, its current assets are €85,361, and its current liabilities are €43,262. Using the above equation, company XYZ’s working capital turnover is:

This means that during the period, the company has used (and of course replaced) its working capital 4.5 times to generate sales.

Interpretation of results

As with the majority of turnover ratios, the results should be interpreted on an industry sector basis to provide an accurate benchmark. However, in general, a high working capital turnover ratio usually indicates that the company is actively generating sales from its working capital, which is a positive indicator of future prospects. If the ratio increases significantly over the years however, or seems excessively high in relation to sector peers, this could indicate that the company is overtrading, ie taking on large orders that it does not have the resources to fulfil, and/or that a high proportion of the business’s assets are fixed assets (ie long-term assets such as buildings and machinery that are not easily converted into cash). Being top-heavy on fixed assets brings the available working capital down and means that the company lacks liquidity. This lack of liquidity could mean that the company would struggle to pay all of its debts.

Meanwhile, a low working capital turnover ratio could point to inefficiencies as the company is not generating a significant return on its assets, which can signal financial difficulty. Some companies, particularly those that are going through periods of rapid growth, do however run with negative working capital as they are able to generate cash extremely quickly. This is often the case in the food outlet or restaurant industry as customers pay for the goods up front. If the company’s working capital turnover is negative, this may be a sign of an efficient business strategy, particularly if inventory is tactically low, ie just sufficient to meet demand. A well-known organisation that has operated using this business model is McDonalds.

Many companies on the verge of bankruptcy also have negative working capital turnover though, so it is important to make sure that a company with negative working capital turnover has both low inventory and accounts receivable. If the company has high accounts receivable, this may indicate that it is not collecting its debts efficiently and that products have not been paid for up front. This, combined with a low inventory, would mean that the company is owed money and yet has no stock to sell to cover these debts.

What is working capital?

One of the most common needs for working capital occurs when a business must increase its inventory and accounts receivable in order to grow its customer base and revenues. Let’s first be clear on what the term ‘working capital’ really means. From an accounting standpoint, working capital = current assets – current liabilities. Current assets are short term in nature and can be converted quickly to cash, primarily accounts receivable and inventory. Current liabilities are obligations that come due within one year, primarily accounts payable and short term debt.

The term “working capital” is often used incorrectly when talking about the financing needs of a business, especially for a start up business. For example, if a start up business is looking to finance typical operating expenses like an advertising budget and salaries for new employees, what it really needs is “long term capital” or equity. If a business is unable to support the expenses for advertising and salaries then most likely it is under-capitalized. If the company is projecting losses for the first year then most likely “equity” is what is needed, not “working capital.”

Money used to fund growth in short term assets like inventory and accounts receivables is correctly considered “working capital” financing.

you need to understand how money flows through your business. In other words, you need to understand your “working capital cycle.” The cycle consists of:

- How quickly current assets (e.g. accounts receivables & inventory) are turned into cash

- How quickly that cash is used to pay current liabilities (e.g. accounts payable). The working capital cycle is also referred to as the “Turnover Rates” for accounts receivables, inventory, and accounts payable.