Delivering value throughout the automation journey

Revenue

In accounting, revenue is the income that a business has from its normal business activities, usually from the sale of goods and services to customers. Revenue is also referred to as sales or turnover. Some companies receive revenue from interest, royalties, or other fees.[1] Revenue may refer to business income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement it is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses).[2]

For non-profit organizations, annual revenue may be referred to as gross receipts.[3] This revenue includes donations from individuals and corporations, support from government agencies, income from activities related to the organization's mission, and income from fundraising activities, membership dues, and financial securities such as stocks, bonds or investment funds.

In general usage, revenue is income received by an organization in the form of cash or cash equivalents. Sales revenue or revenues is income received from selling goods or services over a period of time. Tax revenue is income that a government receives from taxpayers.

In more formal usage, revenue is a calculation or estimation of periodic income based on a particular standard accounting practice or the rules established by a government or government agency. Two common accounting methods, cash basis accounting and accrual basis accounting, do not use the same process for measuring revenue. Corporations that offer shares for sale to the public are usually required by law to report revenue based on generally accepted accounting principles or International Financial Reporting Standards.

In a double-entry bookkeeping system, revenue accounts are general ledger accounts that are summarized periodically under the heading Revenue or Revenues on an income statement. Revenue account names describe the type of revenue, such as "Repair service revenue", "Rent revenue earned" or "Sales .

Business revenue[edit]

Money income from activities that are ordinary for a particular corporation, company, partnership, or sole-proprietorship. For some businesses, such as manufacturing or grocery, most revenue is from the sale of goods. Service businesses such as law firms and barber shops receive most of their revenue from rendering services. Lending businesses such as car rentals and banks receive most of their revenue from fees and interest generated by lending assets to other organizations or individuals.Revenues from a business's primary activities are reported as sales, sales revenue or net sales. This includes product returns and discounts for early payment of invoices. Most businesses also have revenue that is incidental to the business's primary activities, such as interest earned on deposits in a demand account. This is included in revenue but not included in net sales. Sales revenue does not include sales tax collected by the business.

Other revenue (a.k.a. non-operating revenue) is revenue from peripheral (non-core) operations. For example, a company that manufactures and sells automobiles would record the revenue from the sale of an automobile as "regular" revenue. If that same company also rented a portion of one of its buildings, it would record that revenue as “other revenue” and disclose it separately on its income statement to show that it is from something other than its core operations. The combination of all the revenue generating systems of a business is called its revenue model.

Financial statement analysis

Revenue is a crucial part of financial statement analysis. The company’s performance is measured to the extent to which its asset inflows (revenues) compare with its asset outflows (expenses). Net income is the result of this equation, but revenue typically enjoys equal attention during a standard earnings call. If a company displays solid “top-line growth”, analysts could view the period’s performance as positive even if earnings growth, or “bottom-line growth” is stagnant. Conversely, high net income growth would be tainted if a company failed to produce significant revenue growth. Consistent revenue growth, if accompanied by net income growth, contributes to the value of an enterprise and therefore the stock price.Revenue is used as an indication of earnings quality. There are several financial ratios attached to it, the most important being gross margin and profit margin. Also, companies use revenue to determine bad debt expense using the income statement method.

Price / Sales is sometimes used as a substitute for a Price to earnings ratio when earnings are negative and the P/E is meaningless. Though a company may have negative earnings, it almost always has positive revenue.

Gross Margin is a calculation of revenue less cost of goods sold, and is used to determine how well sales cover direct variable costs relating to the production of goods.

Net income/sales, or profit margin, is calculated by investors to determine how efficiently a company turns revenues into profits.

Government revenue

Government revenue includes all amounts of money (i.e., taxes and fees) received from sources outside the government entity. Large governments usually have an agency or department responsible for collecting government revenue from companies and individuals.Government revenue may also include reserve bank currency which is printed. This is recorded as an advance to the retail bank together with a corresponding currency in circulation expense entry, that is, the income derived from the Official Cash rate payable by the retail banks for instruments such as 90-day bills. There is a question as to whether using generic business-based accounting standards can give a fair and accurate picture of government accounts, in that with a monetary policy statement to the reserve bank directing a positive inflation rate, the expense provision for the return of currency to the reserve bank is largely symbolic, such that to totally cancel the currency in circulation provision, all currency would have to be returned to the reserve bank and cancelled.

Association non-dues revenue

Association non-dues revenue is revenue generated through means besides association membership fees. This revenue can be found through means of sponsorships, donations or outsourcing the association's digital media outlets.Accounting terms

- Net sales = gross sales – (customer discounts, returns, and allowances)

- Gross profit = net sales – cost of goods sold

- Operating profit = gross profit – total operating expenses

- Net profit = operating profit – taxes – interest

- Net profit = net sales – cost of goods sold – operating expense – taxes – interest

Legal tender

One of the everyday jobs of the treasurer is to manage the cash, and flow of funds through the organization. If the amount or receipt and collection activities are out of control, the entire firm may face bankruptcy. There is an old saying, “If you pay attention to the pennies, the dollars will take care of themselves.” In this spirit, this paper looks at taking care of the daily amounts of cash flowing through the firm in a systematic fashion. The purpose is to understand the importance of the inter-relationships involved and to be able to measure the amount and speed of the cash flow. Once something can be measured, it can be managed.

Most of us have more options for raising money than we think. ... programs that go under names such as “working capital loan” or “line of credit. ... Charge card and credit card companies, as well as some electronic payment .

Legal tender is a medium of payment recognized by a legal system to be valid for meeting a financial obligation.[1] Paper currency and coins are common forms of legal tender in many countries. Legal tender is variously defined in different jurisdictions. Formally, it is anything which when offered in payment extinguishes the debt. Thus, personal cheques, credit cards, and similar non-cash methods of payment are not usually legal tender. The law does not relieve the debt obligation until payment is tendered. Coins and banknotes are usually defined as legal tender. Some jurisdictions may forbid or restrict payment made other than by legal tender. For example, such a law might outlaw the use of foreign coins and bank notes or require a license to perform financial transactions in a foreign currency.

Generally, designation of a particular form of money as legal tender means "that the designated money is valid payment for all debts unless there is a specific agreement to the contrary".[2] In some jurisdictions legal tender can be refused as payment if no debt exists prior to the time of payment (where the obligation to pay may arise at the same time as the offer of payment). For example, vending machines and transport staff do not have to accept the largest denomination of banknote. Shopkeepers may reject large banknotes: this is covered by the legal concept known as invitation to treat. Under the law, United States money as identified above is a valid and legal offer of payment for antecedent debts when tendered to a creditor. By contrast, federal statutes do not require that someone who is not a pre-existing creditor must accept currency or coins as payment for goods or services. Private businesses may formulate their own policies on whether to accept cash unless state law requires otherwise.[

The right, in many jurisdictions, of a trader to refuse to do business with any person, means a purchaser may not insist on making a purchase and so declaring a legal tender in law, as anything other than an offered payment for debts already incurred would not be effective.

Etymology

The term "legal tender" is from Middle English tendren, French tendre (verb form), meaning to offer. The Latin root is tendere (to stretch out), and the sense of tender as an offer is related to the etymology of the English word "extend" (to hold outward).Withdrawal and replacement of legal tender

Demonetisation

Coins and banknotes may cease to be legal tender if new notes of the same currency replace them or if a new currency is introduced replacing the former one.[6] Examples of this are:- The United Kingdom, adopting decimal currency in place of pounds, shillings, and pence in 1971, Banknotes remained unchanged (except for the replacement of the 10 shilling note by the 50 pence coin). In 1968 and 1969 decimal coins which had precise equivalent values in the old currency (5p, 10p, 50p - 1, 2, and 10 shillings respectively) were introduced, while decimal coins with no precise equivalent (½p, 1p, 2p equal to 1.2d (old pence), 2.4d, 4.8d respectively) were introduced on 15 February 1971. The smallest and largest non-decimal circulating coins, the half penny and half crown, were withdrawn in 1969, and the other non-decimal coins with no precise equivalent in the new currency (1d, 3d) were withdrawn later in 1971. Non-decimal coins with precise decimal equivalents (6d ( = 2½p), 1 and 2 shillings) remained legal tender either until the coins no longer circulated (1980 in the case of the 6d), or the equivalent decimal coins were reduced in size in the early 1990s. The 6d coin was permitted to remain in large circulation throughout the United Kingdom due to the London Underground committee's large investment in coin-operated ticketing machines that used it.[ Old coins returned to the Royal Mint through the UK banking system will be redeemed by exchanging them for legal tender currency with no time limits; but coins issued before 1947 have a higher value for their silver content than for their monetary value.[

- The successor states of the Soviet Union replacing the Soviet ruble in the 1990s.[

- Currencies used in the Eurozone before being replaced by the euro are not legal tender, but all banknotes are redeemable for euros for a minimum of 10 years (for certain notes, there is no time limit).[

- India demonetised its 500 and 1000 rupee notes on November 8, 2016. This action affected 86 percent of all cash in circulation. The demonetisation action was intended to curb black money, the hoarding of unaccounted cash, and sponsorship of terrorism, but also led to long queues from bank runs, leaving more than 30 people dead.[7] The old notes are now being replaced by new 500 and 2000 rupee notes.

In the case of the euro, coins and banknotes of former national currencies were in some cases considered legal tender from 1 January 1999 until 28 February 2002. Legally, those coins and banknotes were considered non-decimal sub-divisions of the euro.

When the Iraqi Swiss dinar ceased to be legal tender in Iraq, it still circulated in the northern Kurdish regions, and despite lacking government backing, it had a stable market value for more than a decade. This example is often cited to demonstrate that the value of a currency is not derived purely from its legal status[ (but this currency would not be legal tender).

This is also true of the paper money issued by the Confederate States of America during the American Civil War. The Confederate currency became worthless by its own terms after the war, since it could only be redeemed a stated number of years after a peace treaty was signed between the Confederacy and the United States (which never happened, as the Confederacy was defeated and dissolved).

Demonetisation is currently prohibited in the United States and the Coinage Act of 1965 applies to all US coins and currency regardless of age. The closest historical equivalent in the US, other than Confederate money, was from 1933 to 1974, when the government banned most private ownership of gold bullion, including gold coins held for non-numismatic purposes. Now, however, even surviving pre-1933 gold coins are legal tender under the 1964 act

Withdrawal from circulation

Banknotes and coins may be withdrawn from circulation, but remain legal tender. United States banknotes issued at any date remain legal tender even after they are withdrawn from circulation. Canadian 1- and 2-dollar bills remain legal tender even if they have been withdrawn and replaced by coins, but Canadian $1,000 bills remain legal tender even if they are removed from circulation as they arrive at a bank. However, Bank of England notes that are withdrawn from circulation generally cease to be legal tender but remain redeemable for current currency at the Bank of England itself or by post. All paper and polymer issues of New Zealand banknotes issued from 1967 onwards (and 1- and 2-dollar notes until 1993) are still legal tender; however, 1- and 2-cent coins are no longer used in Australia and New Zealand.Cashless society

A cashless society describes an economic state whereby financial transactions are not conducted with money in the form of physical banknotes or coins, but rather through the transfer of digital information (usually an electronic representation of money) between the transacting partiesCashless societies have existed, based on barter and other methods of exchange, and cashless transactions have also become possible using digital currencies such as bitcoin. However this article discusses and focuses on the term "cashless society" in the sense of a move towards, and implications of, a society where cash is replaced by its digital equivalent - in other words, legal tender (money) exists, is recorded, and is exchanged only in electronic digital form.Commemorative issues

Sometimes currency issues such as commemorative coins or transfer bills may be issued that are not intended for public circulation but are nonetheless legal tender. An example of such currency is Maundy money. Some currency issuers, particularly the Scottish banks, issue special commemorative banknotes which are intended for ordinary circulation. As well, some standard coins are minted on higher-quality dies as 'uncirculated' versions of the coin, for collectors to purchase at a premium; these coins are nevertheless legal tender. Some countries issue precious-metal coins which have a currency value indicated on them which is far below the value of the metal the coin contains: these coins are known as "non-circulating legal tender" or "NCLT".United States

Before the Civil War (1861 to 1865), silver coins were legal tender only up to the sum of $5. Before 1853, when U.S. silver coins were reduced in weight 7%, coins had exactly their value in metal (from 1830 to 1852). Two silver 50 cent coins had exactly $1 worth of silver. A gold U.S. dollar of 1849 had $1 worth of gold. With the flood of gold coming out of the California mines in the early 1850s, the price of silver rose (gold went down). Thus, 50 cent coins of 1840 to 1852 were worth 53 cents if melted down. The government could increase the value of the gold coins (expensive) or reduce the size of all U.S. silver coins. With the reduction of 1853, a 50-cent coin now had only 48 cents of silver. This is the reason for the $5 limit of silver coins as legal tender; paying somebody $100 in the new silver coins would be giving them $96 worth of silver. Most people preferred bank check or gold coins for large purchases.During the early American Civil War, the federal government first issued United States Notes (the first greenback notes) which were not redeemable in gold and silver coins but could be used to pay "all dues" to the federal government. Since land purchases and duties on imports were payable only in gold or the new Demand Notes, the Demand Notes were bought by importers and land speculators for about 97 cents on the gold dollar and never lost value. 1862 greenbacks (Legal Tender Notes) at first traded for 97 cents on the dollar but gained/lost value depending on fortunes of the Union army. The value of Legal Tender Greenbacks swung wildly but trading was from 85 to 33 cents on the gold dollar.

This resulted in a situation in which the greenback "Legal Tender" notes of 1862 were fiat, and so gold and silver were held and paper circulated at a discount because of Gresham's Law. The 1861 Demand Notes were a huge success but robbed the customs house of much needed gold coin (interest on most bonds back then was paid in gold). A money-strapped Congress which had to pay for the war eventually adopted the Legal Tender Act of 1862, issuing United States Notes backed only by treasury securities, and compelled the people to accept the new notes at a discount; prices rose except for those who had gold and/or silver coins.

Following the Civil War, paper currency was disputed as to if it must be accepted as payment. In 1869, Hepburn v. Griswold found that Henry Griswold would not have to accept paper currency because it could not truly be "legal tender" and was unconstitutional as a legally enforceable means to pay debts. This led to the Legal Tender Cases in 1870, which overturned the previous ruling and established the paper currency as constitutional and proper legal tender that must be accepted in all situations.

With the 1884 Supreme Court ruling in Juilliard v. Greenman, the "Supreme Court ruled that Congress had the right to issue notes to be legal tender for the payment of public and private debt. Legal-tender notes are treasury notes or banknotes that, in the eyes of the law, must be accepted in the payment of debts."[37] The ruling in the Legal Tender Cases (which include Juilliard v. Greenman) led to later courts to "support the federal government's invalidation of gold clauses in private contracts in the 1930s."[38]

On the other hand, coins made of gold or silver may not necessarily be legal tender, if they are not fiat money in the jurisdiction where they are proffered as payment. The Coinage Act of 1965 states (in part):

United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes and dues. Foreign gold or silver coins are not legal tender for debts.There is no federal law stating that a private business, a person, or an organization must accept currency or coins for payment. Private businesses are free to create their own policies on whether or not they accept cash, unless there is a specific state law which says otherwise. For example, a bus line may prohibit payment of fares in cents or dollar bills. In addition, movie theaters, convenience stores, and gas stations may refuse to accept large denomination currency as a matter of policy or safety

XXX . V Working capital management

Working capital is the capital available for conducting the day-to-day operations of an organization; normally the excess of current assets over current liabilities.

Working capital management is the management of all aspects of both current assets and current liabilities, to minimize the risk of insolvency while maximizing the return on assets.

The main objective of working capital management is to get the balance of current assets and current liabilities right.

Importance of working capital management

Current assets are a major financial position statement item and especially significant to smaller firms. Mismanagement of working capital is therefore a common cause of business failure, e.g.:

- inability to meet bills as they fall due

- demands on cash during periods of growth being too great (overtrading)

- overstocking

Working capital management is a key factor in an organisation's long-term success.

The balancing act: Profitability v Liquidity

The decision regarding the level of overall investment in working capital is a cost/benefit trade-off - liquidity versus profitability.

Unprofitable companies can survive if they have liquidity. Profitable companies can fail if they run out of cash to pay their liabilities (wages, amounts due to suppliers, overdraft interest, etc.).

Liquidity in the context of working capital management means having enough cash or ready access to cash to meet all payment obligations when these fall due. The main sources of liquidity are usually:

- cash in the bank

- short-term investments that can be cashed in easily and quickly

- cash inflows from normal trading operations (cash sales and payments by receivables for credit sales)

- an overdraft facility or other ready source of extra borrowing.

Cash balances and cash flows need to be monitored just as closely as trading profits.

Elements of working capital

Managing working capital involves managing the individual elements which make up working capital:

- inventory (stock)receivables

- (debtors)payables

- (creditors)cash

Funding strategies

In the same way as for long-term investments, a firm must make a decision about what source of finance is best used for the funding of working capital requirements.

The decision about whether to choose short- or long-term options depends upon a number of factors:

- the extent to which current assets are permanent or fluctuating

- the costs and risks of short-term finance

- the attitude of management to risk

Permanent or fluctuating current assets

In most businesses a proportion of the current assets are fixed over time, i.e. 'permanent'. For example:

- buffer inventory,

- receivables during the credit period,

- minimum cash balances.

The choice of how to finance the permanent current assets is a matter for managerial judgement, but includes an analysis of the cost and risks of short-term finance.

The attitude of management to risk: aggressive, conservative and matching funding policies

There is no ideal funding package, but three approaches may be identified.

- Aggressive - finance most current assets, including 'permanent' ones, with short-term finance. Risky but profitable.

- Conservative - long-term finance is used for most current assets, including a proportion of fluctuating current assets. Stable but expensive.

- Matching - the duration of the finance is matched to the duration of the investment.

A firm choosing to have a lower level of working capital than rivals is said to have an 'aggressive' approach, whereas a firm with a higher level of working capital has a 'conservative' approach.

An aggressive approach will result in higher profitability and higher risk, while a conservative approach will result in lower profitability and lower risk.

Over-capitalisation

If there are excessive inventories, accounts receivable and cash,and very few accounts payable, there will be an over-investment by the company in current assets. Working capital will be excessive and the company will be over-capitalised.

Overtrading

Cash flow is the lifeblood of the thriving business. Effective and efficient management of the working capital investment is essential to maintaining control of business cash flow. Management must have full awareness of the profitability versus liquidity trade-off.

For example, healthy trading growth typically produces:

- increased profitability

- the need to increase investment in non-current assets and working capital.

In contrast to over-capitalisation, if the business does not have access to sufficient capital to fund the increase, it is said to be"overtrading". This can cause serious trouble for the business as it is unable to pay its business creditors.

The cash operating cycle

The elements of the operating cycle

The cash operating cycle is the length of time between the company's outlay on raw materials, wages and other expenditures and the inflow of cash from the sale of goods.

The faster a firm can 'push' items around the cycle the lower its investment in working capital will be.

Calculation of the cash operating cycle

For a manufacturing business, the cash operating cycle is calculated as:

For a wholesale or retail business, there will be no raw materials or WIP holding periods, and the cycle simplifies to:

The cycle may be measured in days, weeks or months. The holding periods are calculated using a series of working capital ratios.

Factors affecting the length of the operating cycle

Length of the cycle depends on:

- liquidity versus profitability decisions

- terms of trade

- management efficiency

- industry norms, e.g. retail versus construction.

The optimum level of working capital is the amount that results in no idle cash or unused inventory, but that does not put a strain on liquid resources.

Working capital ratios

Ratios to determine the operating cycle

The periods used to determine the cash operating cycle are calculated by using a series of working capital ratios.

The ratios for the individual components (inventory, receivables and payables) are normally expressed as the number of days/weeks/months of the relevant income statement figure they represent.

Inventory holding period

This ratio calculates the length of time inventory is held between purchase and sale.

Calculated as:

In some cases, a more detailed breakdown of inventory may be required. Inventory holding periods can be calculated for each type of inventory: raw materials, work-in-progress and finished goods.

Raw material inventory holding period

The length of time raw materials are held between purchase and being used in production.

Calculated as:

WIP holding period

The length of time goods spend in production.

Calculated as:

Finished goods inventory period

The length of time finished goods are held between completion or purchase and sale.

Calculated as:

For all inventory period ratios, a low ratio is usually seen as a sign of good working capital management. It is very expensive to hold inventory and thus minimum inventory holding usually points to good practice.

Trade receivables days

The length of time credit is extended to customers.

Calculated as:

Generally shorter credit periods are seen as financially sensible but the length will also depend upon the nature of the business.

Trade payables days

The average period of credit extended by suppliers.

Calculated as:

Generally, increasing payables days suggests advantage is being taken of available credit but there are risks:

- losing supplier goodwill

- losing prompt payment discounts

- suppliers increasing the price to compensate.

Working capital liquidity ratios

Two key measures, the current ratio and the quick ratio, are used to assess short-term liquidity. Generally a higher ratio indicates better liquidity.

Current ratio

Measures how much of the total current assets are financed by current liabilities.

A measure of 2:1 means that current liabilities can be paid twice over out of existing current assets.

Quick (acid test) ratio

The quick or acid test ratio measures how well current liabilities are covered by liquid assets. This ratio is particularly useful where inventory holding periods are long.

A measure of 1:1 means that the company is able to meet existing liabilities if they all fall due at once.

Working capital turnover

One final ratio that relates to working capital is the working capital turnover ratio and is calculated as:

This measures how efficiently management is utilising its investment in working capital to generate sales and can be useful when assessing whether a company is overtrading. It must be interpreted in the light of the other ratios used.

Working capital investment levels

The level of working capital required (the financial position statement figure) is affected by the following factors:

- The nature of the business,

- Uncertainty in supplier deliveries.

- The overall level of activity of the business.

- The company's credit policy.

- The credit policy of suppliers.

- The length of the operating cycle.

The working capital ratios can be used to predict the levels of investment required. This is done by re-arranging the formulas. For example:

XXX . V0 Business Planning Papers: Managing Working Capital

The idea :

- Working Capital Cycle

- Sources of Additional Working Capital

- Handling Receivables (Debtors)

- Managing Payables (Creditors)

- Inventory Management

- Key Working Capital Ratios

1. Working Capital CycleCash flows in a cycle into, around and out of a business. It is the business's life blood and every manager's primary task is to help keep it flowing and to use the cashflow to generate profits. If a business is operating profitably, then it should, in theory, generate cash surpluses. If it doesn't generate surpluses, the business will eventually run out of cash and expire. Click here for more information about the vital distinction between profits and cashflow.The faster a business expands, the more cash it will need for working capital and investment. The cheapest and best sources of cash exist as working capital right within business. Good management of working capital will generate cash will help improve profits and reduce risks. Bear in mind that the cost of providing credit to customers and holding stocks can represent a substantial proportion of a firm's total profits. There are two elements in the business cycle that absorb cash - Inventory (stocks and work-in-progress) and Receivables (debtors owing you money). The main sources of cash are Payables (your creditors) and Equity and Loans. Each component of working capital (namely inventory, receivables and payables) has two dimensions ........TIME ......... and MONEY. When it comes to managing working capital - TIME IS MONEY. If you can get money to move faster around the cycle (e.g. collect monies due from debtors more quickly) or reduce the amount of money tied up (e.g. reduce inventory levels relative to sales), the business will generate more cash or it will need to borrow less money to fund working capital. As a consequence, you could reduce the cost of bank interest or you'll have additional free money available to support additional sales growth or investment. Similarly, if you can negotiate improved terms with suppliers e.g. get longer credit or an increased credit limit, you effectively create free finance to help fund future sales.

| |

It can be tempting to pay cash, if available, for fixed assets e.g. computers, plant, vehicles etc. If you do pay cash, remember that this is now longer available for working capital. Therefore, if cash is tight, consider other ways of financing capital investment - loans, equity, leasing etc. Similarly, if you pay dividends or increase drawings, these are cash outflows and, like water flowing down a plug hole, they remove liquidity from the business.

| ||||||||||||||||||||||||||||||

2. Sources of Additional Working CapitalSources of additional working capital include the following:If you have insufficient working capital and try to increase sales, you can easily over-stretch the financial resources of the business. This is called overtrading. Early warning signs include:

| ||||||||||||||||||||||||||||||

3. Handling Receivables (Debtors)Cashflow can be significantly enhanced if the amounts owing to a business are collected faster. Every business needs to know.... who owes them money.... how much is owed.... how long it is owing.... for what it is owed.

Debtors due over 90 days (unless within agreed credit terms) should generally demand immediate attention. Look for the warning signs of a future bad debt. For example.........

| ||||||||||||||||||||||||||||||

4. Managing Payables (Creditors)Creditors are a vital part of effective cash management and should be managed carefully to enhance the cash position.Purchasing initiates cash outflows and an over-zealous purchasing function can create liquidity problems. Consider the following:

Remember, a good supplier is someone who will work with you to enhance the future viability and profitability of your company. | ||||||||||||||||||||||||||||||

5. Inventory ManagementManaging inventory is a juggling act. Excessive stocks can place a heavy burden on the cash resources of a business. Insufficient stocks can result in lost sales, delays for customers etc.The key is to know how quickly your overall stock is moving or, put another way, how long each item of stock sit on shelves before being sold. Obviously, average stock-holding periods will be influenced by the nature of the business. For example, a fresh vegetable shop might turn over its entire stock every few days while a motor factor would be much slower as it may carry a wide range of rarely-used spare parts in case somebody needs them. Nowadays, many large manufacturers operate on a just-in-time (JIT) basis whereby all the components to be assembled on a particular today, arrive at the factory early that morning, no earlier - no later. This helps to minimize manufacturing costs as JIT stocks take up little space, minimize stock-holding and virtually eliminate the risks of obsolete or damaged stock. Because JIT manufacturers hold stock for a very short time, they are able to conserve substantial cash. JIT is a good model to strive for as it embraces all the principles of prudent stock management. The key issue for a business is to identify the fast and slow stock movers with the objectives of establishing optimum stock levels for each category and, thereby, minimize the cash tied up in stocks. Factors to be considered when determining optimum stock levels include: Remember that stock sitting on shelves for long periods of time ties up money which is not working for you. For better stock control, try the following:

| ||||||||||||||||||||||||||||||

6. Key Working Capital RatiosThe following, easily calculated, ratios are important measures of working capital utilization.

Once ratios have been established for your business, it is important to track them over time and to compare them with ratios for other comparable businesses or industry sectors. When planning the development of a business, it is critical that the impact of working capital be fully assessed when making cashflow forecasts. |

XXX . V000 case e-money

Electronic Money

Electronic money (e-money) is broadly defined as an electronic store of monetary value on a technical device that may be widely used for making payments to entities other than the e-money issuer. The device acts as a prepaid bearer instrument which does not necessarily involve bank accounts in transactions.E-money products can be hardware-based or software-based, depending on the technology used to store the monetary value.

Hardware-based products

In the case of hardware-based products, the purchasing power resides in a personal physical device, such as a chip card, with hardware-based security features. Monetary values are typically transferred by means of device readers that do not need real-time network connectivity to a remote server.Software-based products

Software-based products employ specialised software that functions on common personal devices such as personal computers or tablets. To enable the transfer of monetary values, the personal device typically needs to establish an online connection with a remote server that controls the use of the purchasing power. Schemes mixing both hardware and software-based features also exist.ECB statistics on electronic money do not distinguish between hardware-based and software-based e-money.

- Euro-denominated electronic money in circulation in the euro area, outstanding amounts

- Euro-denominated electronic money in circulation, all available series

Article 2(1) of the Directive defines an “electronic money institution” as a legal person that has been granted authorisation to issue e-money. Furthermore, according to Article 2(2) of the Directive, “electronic money” means “electronically, including magnetically, stored monetary value as represented by a claim on the issuer which is issued on receipt of funds for the purpose of making payment transactions […], and which is accepted by a natural or legal person other than the electronic money issuer”. Credit institutions, as well as other financial and non-financial institutions, may issue e-money.

In order to align the ECB’s monetary financial institution (MFI) balance sheet statistics with the new definitions, Regulation ECB/2008/32 was amended by Regulation ECB/2011/12 and Guideline ECB/2007/9 by Guideline ECB/2011/13. Data complying with the revised reporting scheme are available as of the reporting period December 2011.

Data on e-money issued by euro area MFIs start in September 1997, while national data may start later depending on their date of availability. As a consequence, as statistical developments are affected by changes in the reporting population, statistical developments of euro area aggregates are affected by changes in the number of euro area countries for which e-money statistics are available.

Aggregated total issuance by euro area MFIs is available on a monthly basis, while national issuance by all electronic money institutions is available only annually.

The amount outstanding of e-money issued by euro area MFIs is included in the item “overnight deposits” on the MFI balance sheet

XXX . V0000 The Modern Working Capital Management

Traditionally, investors, creditors and bankers have considered working capital as a critical element to watch, as important as the financial position portrayed in the balance sheet and the profitability shown in the income statement. Working capital is a measure of the company’s efficiency and short term financial health. It refers to that part of the company’s capital, which is required for financing short-term or current assets such a cash marketable securities, debtors and inventories. It is a company’s surplus of current assets over current liabilities, which measures the extent to which it can finance any increase in turnover from other fund sources. Funds thus, invested in current assets keep revolving and are constantly converted into cash and this cash flow is again used in exchange for other current assets. That is why working capital is also known as revolving or circulating capital or short-term capital.

Formula for Working Capital: “Current Assets – Current Liabilities”

Illustration to calculate working capital:

Components of the balance sheet: (Rs)

Current Assets

|

Current Liabilities

| ||

|---|---|---|---|

Cash

|

1500

|

Accounts payable

|

1500

|

Marketable securities

|

500

|

Accrued expenses

|

1000

|

Accounts receivables

|

2000

|

Notes payable

|

500

|

Inventory

|

2500

|

Current portion- long term debt

|

1500

|

Total current assets

|

6500

|

Total current liabilities

|

4500

|

Current Assets

Cash

Current Liabilities

1500

undefined

Accounts payable

undefined

1500

Current Assets

Marketable securities

Current Liabilities

500

undefined

Accrued expenses

undefined

1000

Current Assets

Accounts receivables

Current Liabilities

2000

undefined

Notes payable

undefined

500

Current Assets

Inventory

Current Liabilities

2500

undefined

Current portion- long term debt

undefined

1500

Current Assets

Total current assets

Current Liabilities

6500

undefined

Total current liabilities

undefined

4500

WC = CA- CL

=6500-4500

=2000

Net working capital is defined as the excess of current assets over current liabilities. Working capital mentioned in the balance sheet is an indication of the company’s current solvency in repaying its creditors. That is why when companies indicate shortage of working capital they in fact imply scarcity of cash resources.

Factors effecting working capital:

• Nature of business: generally working capital is higher in manufacturing compared to service based organizations• Volume of sales: higher the sale, higher the working capital required

• Seasonality: peak seasons for sales need more working capital

• Length of operating and cash cycle: longer the operating and cash cycle, more is the requirement of working capital

Working capital Approaches:

A) Matching or hedging approach: This approach matches assets and liabilities to maturities. Basically, a company uses long term sources to finance fixed assets and permanent current assets and short term financing to finance temporary current assets.Example: A fixed asset which is expected to provide cash flow for 5 years should be financed by approx 5 years long-term debts. Assuming the company needs to have additional inventories for 2 months, it will then seek short term 2 months bank credit to match it.

B) Conservative approach: it is conservative because the company prefers to have more cash on hand. That is why, fixed and part of current assets are financed by long-term or permanent funds. As permanent or long-term sources are more expensive, this leads to “lower risk lower return”.

C) Aggressive approach: The Company wants to take high risk where short term funds are used to a very high degree to finance current and even fixed assets.

Classification of Working Capital:

Working capital can be categorized on basis of Concept (gross working capital and net working capital) and basis of time (Permanent/ fixed WC and temporary/variable WC). The two major components of Working Capital are Current Assets and Current Liabilities. One of the major aspects of an effective working capital management is to have regular analysis of the company’s currents assets and liabilities. This helps to take into account unforeseen events such as changes in the market conditions and competitor activities. Furthermore, steps taken to increase sales income and collecting accounts receivable also improves a company’s working capital.Working Capital in adequate amount:

For every business entity adequate amount of working capital is required to run the operations. It needs to be seen that there is neither excess nor shortage of working capital. Both excess as well as shortage of working capital situations are bad for any business. However, out of the two, inadequacy or shortage of working capital is more dangerous from the point of view of the company operations. Inadequate working capital has its disadvantages where the company is not capable to pay off its short term liabilities in time, difficulty in exploring favorable market situations, day to day liquidity worsens and ROA and ROI fall sharply. On the other hand, one should keep in mind that excess of working capital also leads to wrong indications like idle funds, poor ROI, unnecessary purchase and accumulation of inventories over required level due to low rate of return on investments, all of which leads to fall in the market value of shares and credit worthiness of the company.Working capital cycle:

The working capital cycle (WCC) is the amount of time it takes to turn the net current assets and current liabilities into cash. The longer the cycle is, the longer a business is tying-up funds in its working capital without earning any return on it. This is also one of the essential parameters to be recorded in working capital management.Working Capital Management:

Working Capital Management (WCM) refers to all the strategies adopted by the company to manage the relationship between its short term assets and short term liabilities with the objective to ensure that it continues with its operations and meet its debt obligations when they fall due. In other words, it refers to all aspects of administration of current assets and current liabilities. Efficient management of working capital is a fundamental part of the overall corporate strategy. The WC policies of different companies have an impact on the profitability, liquidity and structural health of the organization. Although investing in good long-term capital projects receives more emphasis than the day-to-day work associated with managing working capital, companies that do not handle this financial aspect (working capital) well will not attract the capital necessary to fund those highly visible ventures; in other words, you must get through the short run to get to the long run.Components associated with WCM:

Often the interrelationships among the working capital components create real challenges for the financial managers. Inventory is purchased from suppliers, sale of which generates accounts receivable and collected in cash from customers to pay off those suppliers. Working capital has to be managed because the firm cannot always control how quickly the customers will buy, and once they have made purchases, exactly when they will pay. That is why; controlling the “cash-to-cash” cycle is paramount.The different components of working capital management of any organization are:

• Cash and Cash equivalents

• Inventory

• Debtors / accounts receivables

• Creditors / accounts payable

A) Cash and Cash equivalents:

One of the most important working capital components to be managed by all organizations is cash and cash equivalents. Cash management helps in determining the optimal size of the firm’s liquid asset balance. It indicates the appropriate types and amounts of short-term investments alongwith efficient ways of controlling collection and payout of cash. Good cash management implies the co-relation between maintaining adequate liquidity with minimum cash in bank. All companies strongly emphasize on cash management as it is the key to maintain the firm’s credit rating, minimize interest cost and avoid insolvency.B) Management of inventories:

Inventories include raw material, WIP (work in progress) and finished goods. Where excessive stocks can place a heavy burden on the cash resources of a business, insufficient stocks can result in reduced sales, delays for customers etc. Inventory management involves the control of assets that are produced to be sold in the normal course of business.For better stock/inventory control:

o Regularly review the effectiveness of existing purchase and inventory systemso Keep a track of stocks for all major items of inventory

o Slow moving stock needs to be disposed as it becomes difficult to sell if kept for long

o Outsourcing should also be a part of the strategy where part of the production can be done through another manufacturer

o A close check needs to be kept on the security procedures as well

C) Management of receivables:

Receivables contribute to a significant portion of the current assets. For investments into receivables there are certain costs (opportunity cost and time value) that any company has to bear, alongwith the risk of bad debts associated to it. It is, therefore necessary to have a proper control and management of receivables which helps in taking sound investment decisions in debtors. Thereby, for effective receivables management one needs to have control of the credits and make sure clear credit practices are a part of the company policy, which is adopted by all others associated with the organization. One has to be vigilant enough when accepting new accounts, especially larger ones. Thereby, the principle lies in establishing appropriate credit limits for every customer and stick to them.Effectively managing accounts receivables:

o Process and maintain records efficiently by regularly coordinating and communicating with credit managers’ and treasury in-chargeso Prepare performance measurement reports

o Control accuracy and security of accounts receivable records.

o Captive finance subsidiary can be used to centralize accounts receivable functions and provide financing for company’s sales

D) Management of accounts payable:

Creditors are a vital part of effective cash management and have to be managed carefully to enhance the cash position of the business. One has to keep in mind that purchasing initiates cash outflows and an undefined purchasing function can create liquidity problems for the company. The trade credit terms are to be defined by companies as they vary across industries and also among companies.Factors to consider:

o Trade credit and the cost of alternative forms of short-term financing are to be definedo The disbursement float which is the amount paid but not credited to the payers account needs to be controlled

o Inventory management system should be in place

o Appropriate methods need to be adopted for customer-to-business payment through e-commerce

o Company has to centralize the financial function with regards to the number, size and location of vendors

Time and money concept in Working Capital:

Every component of working capital (namely inventory, receivables and payables) has two dimensions TIME and MONEY, in managing working capital. By making the money move faster around the cycle, one can reduce the amount of money tied up. This helps the business generate more cash or it will need to borrow less money to fund its working capital. Consequently, it would either reduce the cost of interest or have free funds to support additional sales growth or investments of the company. Similarly, if one can negotiate on better terms with suppliers i.e. get an increased credit limit or longer credit; it will effectively create additional cash to help fund future sales.Hence to conclude, Working capital in lay men terms can be compared to the blood vessels in any human body which makes the body function properly and thus make maximum utilization of the human or company assets.

XXX . V000000 Working Capital Management: Everything We Need to Know

we start witht he 1) introduction to working capital management, and continue then with 2) the working capital cycle, 3) approaches to working capital management, 4) significance of adequate working capital, 5) factors for determining the amoung of working capital needed.

INTRODUCTION TO WORKING CAPITAL MANAGEMENT

Any firm, from time to time, employs its short-term assets as well as short-term financing sources to carry out its day to day business. It is this management of such assets as well as liabilities which is described as working capital management. Working capital management is a quintessential part of financial management as a subject. It can also be compared with long-term decision-making the process as both of the domains deal with the analysis of risk and profitability.1) Definition of Working Capital

Working capital is formally arrived at by subtracting the current liabilities from current assets of a firm on the day the balance sheet is drawn up. Working capital is also represented by a firm’s net investment in current assets necessary to support its everyday business. Working capital frequently changes its form and is sometimes also referred to as circulating capital. According to Gretsenberg:“circulating capital means current assets of a company that are changed in the ordinary course of business from one form to another.”

2) Types of working capital

Working capital, as mentioned above, can take different forms. For example, it can take the form of cash and then change to inventories and/or receivables and back to cash.- Gross and Net Working Capital: The total of current assets is known as gross working capital whereas the difference between the current assets and current liabilities is known as the net working capital.

- Permanent Working Capital: This type of working capital is the minimum amount of working capital that must always remain invested. In all cases, some amount of cash, stock and/or account receivables are always locked in. These assets are necessary for the firm to carry out its day to day business. Such funds are drawn from long term sources and are necessary for running and existence of the business.

- Variable Working Capital: Working capital requirements of a business firm might increase or decrease from time to time due to various factors. Such variable funds are drawn from short-term sources and are referred to as variable working capital.

3) Objectives of working capital management

The main objectives of working capital management are:- Maintaining the working capital operating cycle and to ensure its smooth operation. Maintaining the smooth operation of the operating cycle is essential for the business to function. The operating cycle here refers to the entire life cycle of a business. From the acquisition of the raw material to the smooth production and delivery of the end products – working capital management strives to ensure smoothness, and it is one of the main objectives of the concept.

- Mitigating the cost of capital. Minimizing the cost of capital is another very important objective that working capital management strives to achieve. The cost of capital is the capital that is spent on maintaining the working capital. It needs to be ensured that the costs involved for maintenance of healthy working capital are carefully monitored, negotiated and managed.

- Maximising the return on current asset investments. Maximising the return on current investments is another objective of working capital management. The ROI on currently invested assets should be greater than the weighted average cost of the capital so that wealth maximization is ensured.

THE WORKING CAPITAL CYCLE

The working capital cycle refers to the minimum amount of time which is required to convert net current assets and net current liabilities into cash. From a more simplistic viewpoint, working capital cycle is the amount of time between the payment for goods supplied and the final receipt of cash accumulated from the sale of the same goods. There are mainly the following elements of which the working capital cycle is comprised of:Cash: The cash refers to the funds available for the purchase of goods. Maintaining a healthy level of liquidity with some buffer is always a best practice. It is extremely important to maintain a reserve fund which can be utilized when:

- There is a shortage of cash inflow for some reason. In the absence of reserve cash, the day to day business will get hampered.

- Some new opportunity springs up. In such a case, the absence of reserve cash will pose a hindrance.

- In case of any contingency, absence of a reserve fund can cripple the company and poses a threat to the solvency of the firm.

- The creditors refer to the accounts payable. It refers to the amount that has to be paid to suppliers for the purchase of goods and /or services.

- Debtors refer to the accounts receivables. It refers to the amount that is collected for providing goods and/or services.

Properties of a healthy working capital cycle

It is essential for the business to maintain a healthy working capital cycle. The following points are necessary for the smooth functioning of the working capital cycle:- Sourcing of raw material: Sourcing of raw material is the beginning point for most businesses. It should be ensured that the raw materials that are necessary for producing the desired goods are available at all times. In a healthy working capital cycle, production ideally should never stop because of the shortage of raw materials.

- Production planning: Production planning is another important aspect that needs to be addressed. It should be ensured that all the conditions that are necessary for the production to start are met. A carefully constructed plan needs to be present in order to mitigate the risks and avert unforeseen issues. Proper planning of production is essential for the production of goods or services and is one of the basic principles that must be followed to achieve smooth functioning of the entire production lifecycle.

- Selling: Selling the produced goods as soon as possible is another objective that should be pursued with utmost urgency. Once the goods are produced and are moved into the inventory, the focus should be on selling the goods as soon as possible.

- Payouts and collections: The accounts receivables need to be collected on time in order to maintain the flow of cash. It is also extremely important to ensure timely payouts to the creditors to ensure smooth functioning of the business.

- Liquidity: Maintaining the liquidity along with some room for adjustments is another important aspect that needs to be kept in mind for the smooth functioning of the working capital cycle.

APPROACHES TO WORKING CAPITAL MANAGEMENT

The short-term interest rates are, in most cases, cheaper compared to their long-term counterparts. This is due to the amount of premium which is higher for short term loans. As a result, financing the working capital from long-term sources means more cost. However, the risk factor is higher in case of short term finances. In case of short-term sources, fluctuations in refinancing rates are a major cause for concern, and they pose a major threat to business.There are mainly three strategies that can be employed in order to manage the working capital. Each of these strategies takes into consideration the risk and profitability factors and has its share of pros and cons. The three strategies are:

- The Conservative Approach: As the name suggests, the conservative strategy involves low risk and low profitability. In this strategy, apart from the permanent working capital, the variable working capital is also financed from the long-term sources. This means an increased cost capital. However, it also means that the risks of interest rate fluctuations are significantly lower.

- The Aggressive Approach: The main goal of this strategy is to maximize profits while taking higher risks. In this approach, the entire variable working capital, some parts or the entire permanent working capital and sometimes the fixed assets are funded from short-term sources. This results in significantly higher risks. The cost capital is significantly decreased in this approach that maximizes the profit.

- The Moderate or the Hedging Approach: This approach involves moderate risks along with moderate profitability. In this approach, the fixed assets and the permanent working capital are financed from long-term sources whereas the variable working capital is sourced from the short-terms sources.

SIGNIFICANCE OF ADEQUATE WORKING CAPITAL

Maintenance of adequate working capital is extremely important because of the following factors:- Adequate working capital ensures sufficient liquidity that ensures the solvency of the organisation.

- Working capital ensured prompt and on-time payments to the creditors of the organisation that helps to build trust and reputation.

- Lenders base their decisions for approving loans based on the credit history of the organisation. A good credit history can not only help an organisation to get fast approvals but also can result in reduced interest rates.

- Earning of profits is not a sufficient guarantee that the company can pay dividends in cash. Adequate working capital ensures that dividends are regularly paid.

- A firm maintaining adequate working capital can afford to buy raw materials and other accessories as and when needed. This ensures an uninterrupted flow of production. Adequate working capital, therefore, contributes to the fuller utilisation of resources of the enterprise.

FACTORS FOR DETERMINING THE AMOUNT OF WORKING CAPITAL NEEDED

Factoring out the amount of working capital needed for running a business is an extremely important as well as difficult task. However, it is extremely critical for any firm to estimate this figure so that it can operate smoothly and be fully functional. There are several factors that need to be considered before arriving at a more or less accurate figure. The following are some of those factors that determine the amount of liquid cash and assets required for any firm to operate smoothly:- Nature of business: A trading company requires large working capital. Industrial companies may require lower working capital. A banking company, for example, requires the maximum amount of working capital. Basic and key industries, public utilities, etc. require low working capital because they have a steady demand and continuous cash-inflow to meet current liabilities.

- Size of the business unit: The amount of working capital depends directly upon the volume of business. The greater the size of a business unit, the larger will be the requirements of working capital.

- Terms of purchase and terms of sale: Use of trade credit may lead to lower working capital while cash purchases will demand larger working capital. Similarly, credit sales will require larger working capital while cash sales will require lower working capital.

- Turnover of inventories: If inventories are large and their turnover is slow, we shall require larger capital but if inventories are small and their turnover is quick, we shall require lower working capital.

- Process of manufacture: Long-running and more complex process of production requires larger working capital while simple, short period process of production requires lower working capital.

- Importance of labour: Capital intensive industries e.g. mechanized and automated industries generally require less working capital while labour intensive industries such as small scale and cottage industries require larger working capital.

XXX . V000000 value-based management

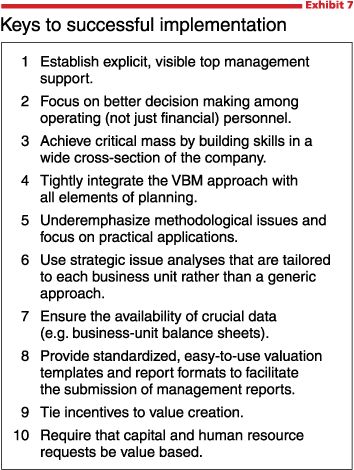

ecent years have seen a plethora of new management approaches for improving organizational performance: total quality management, flat organizations, empowerment, continuous improvement, reengineering, kaizen, team building, and so on. Many have succeeded—but quite a few have failed. Often the cause of failure was performance targets that were unclear or not properly aligned with the ultimate goal of creating value. Value-based management (VBM) tackles this problem head on. It provides a precise and unambiguous metric—value—upon which an entire organization can be built.

The thinking behind VBM is simple. The value of a company is determined by its discounted future cash flows. Value is created only when companies invest capital at returns that exceed the cost of that capital. VBM extends these concepts by focusing on how companies use them to make both major strategic and everyday operating decisions. Properly executed, it is an approach to management that aligns a company's overall aspirations, analytical techniques, and management processes to focus management decision making on the key drivers of value.

Principles

VBM is very different from 1960s-style planning systems. It is not a staff-driven exercise. It focuses on better decision making at all levels in an organization. It recognizes that top-down command-and-control structures cannot work well, especially in large multibusiness corporations. Instead, it calls on managers to use value-based performance metrics for making better decisions. It entails managing the balance sheet as well as the income statement, and balancing long- and short-term perspectives.

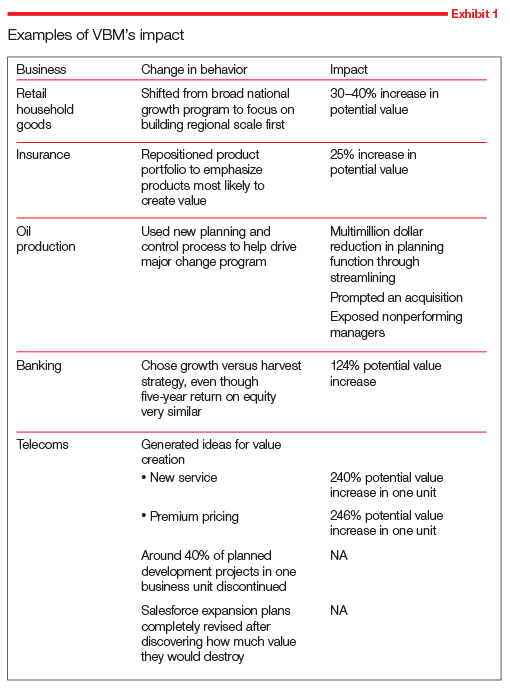

Exhibit 1

When VBM is implemented well, it brings tremendous benefit. It is like restructuring to achieve maximum value on a continuing basis. It works. It has high impact, often realized in improved economic performance, as illustrated in Exhibit 1.

Pitfalls

Yet value-based management is not without pitfalls. It can become a staff-captured exercise that has no effect on operating managers at the front line or on the decisions that they make.A few years ago, the chief planning officer of a large company gave us a preview of a presentation intended for his chief financial officer and board of directors. For about two hours we listened to details of how each business unit had been valued, complete with cash flow forecasts, cost of capital, separate capital structures, and the assumptions underlying the calculations of continuing value. When the time came for us to comment, we had to give the team A+ for their valuation skills. Their methodology was impeccable. But they deserved an F for management content.

None of the company's significant strategic or operating issues were on the table. The team had not even talked to any of the operating managers at the group or business-unit level. Scarcely relevant to the real decision makers, their presentation was a staff-captured exercise that would have no real impact on how the company was run. Instead of value-based management, this company simply had value veneering.

Not methodology

The focus of VBM should not be on methodology. It should be on the why and how of changing your corporate culture. A value-based manager is as interested in the subtleties of organizational behavior as in using valuation as a performance metric and decision-making tool.When VBM is working well, an organization's management processes provide decision makers at all levels with the right information and incentives to make value-creating decisions. Take the manager of a business unit. VBM would provide him or her with the information to quantify and compare the value of alternative strategies and the incentive to choose the value-maximizing strategy. Such an incentive is created by specific financial targets set by senior management, by evaluation and compensation systems that reinforce value creation, and—most importantly—by the strategy review process between manager and superiors. In addition, the manager's own evaluation would be based on long- and short-term targets that measure progress toward the overall value creation objective.

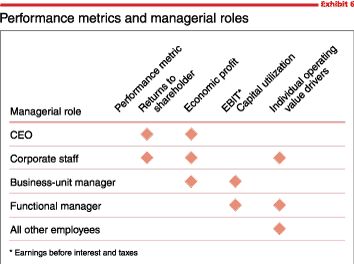

VBM operates at other levels too. Line managers and supervisors, for instance, can have targets and performance measures that are tailored to their particular circumstances but driven by the overall strategy. A production manager might work to targets for cost per unit, quality, and turnaround time. At the top of the organization, on the other hand, VBM informs the board of directors and corporate center about the value of their strategies and helps them to evaluate mergers, acquisitions, and divestitures.

Value-based management can best be understood as a marriage between a value creation mindset and the management processes and systems that are necessary to translate that mindset into action. Taken alone, either element is insufficient. Taken together, they can have a huge and sustained impact.

A value creation mindset means that senior managers are fully aware that their ultimate financial objective is maximizing value; that they have clear rules for deciding when other objectives (such as employment or environmental goals) outweigh this imperative; and that they have a solid analytical understanding of which performance variables drive the value of the company. They must know, for instance, whether more value is created by increasing revenue growth or by improving margins, and they must ensure that their strategy focuses resources and attention on the right option.

Management processes and systems encourage managers and employees to behave in a way that maximizes the value of the organization. Planning, target setting, performance measurement, and incentive systems are working effectively when the communication that surrounds them is tightly linked to value creation.

The value mindset

The first step in VBM is embracing value maximization as the ultimate financial objective for a company. Traditional financial performance measures, such as earnings or earnings growth, are not always good proxies for value creation. To focus more directly on creating value, companies should set goals in terms of discounted cash flow value, the most direct measure of value creation. Such targets also need to be translated into shorter-term, more objective financial performance targets.Companies also need nonfinancial goals—goals concerning customer satisfaction, product innovation, and employee satisfaction, for example—to inspire and guide the entire organization. Such objectives do not contradict value maximization. On the contrary, the most prosperous companies are usually the ones that excel in precisely these areas. Nonfinancial goals must, however, be carefully considered in light of a company's financial circumstances. A defense contractor in the United States, where shrinkage is a certainty, should not adopt a "no layoffs" objective, for example.

Objectives must also be tailored to the different levels within an organization. For the head of a business unit, the objective may be explicit value creation measured in financial terms. A functional manager's goals could be expressed in terms of customer service, market share, product quality, or productivity. A manufacturing manager might focus on cost per unit, cycle time, or defect rate. In product development, the issues might be the time it takes to develop a new product, the number of products developed, and their performance compared with the competition.

Even within the realm of financial goals, managers are often confronted with many choices: boosting earnings per share, maximizing the price/earnings ratio or the market-to-book ratio, and increasing the return on assets, to name a few. We strongly believe that value is the only correct criterion of performance.

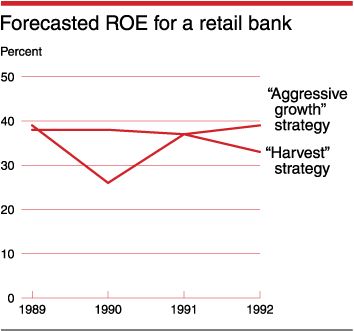

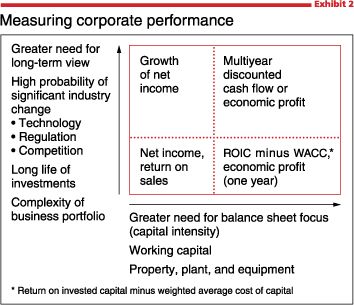

Exhibit 2 compares various measures of corporate performance along two dimensions: the need to take a long-term view and the need to manage the company's balance sheet. Only discounted cash flow valuation handles both adequately. Companies that focus on this year's net income or on return on sales are myopic and may overlook major balance sheet opportunities, such as working capital improvement or capital expenditure efficiency.

Exhibit 2

Finding the value drivers

An important part of VBM is a deep understanding of the performance variables that will actually create the value of the business—the key value drivers. Such an understanding is essential because an organization cannot act directly on value. It has to act on things it can influence—customer satisfaction, cost, capital expenditures, and so on. Moreover, it is through these drivers of value that senior management learns to understand the rest of the organization and to establish a dialogue about what it expects to be accomplished.

A value driver is any variable that affects the value of the company. To be useful, however, value drivers need to be organized so that managers can identify which have the greatest impact on value and assign responsibility for them to individuals who can help the organization meet its targets.

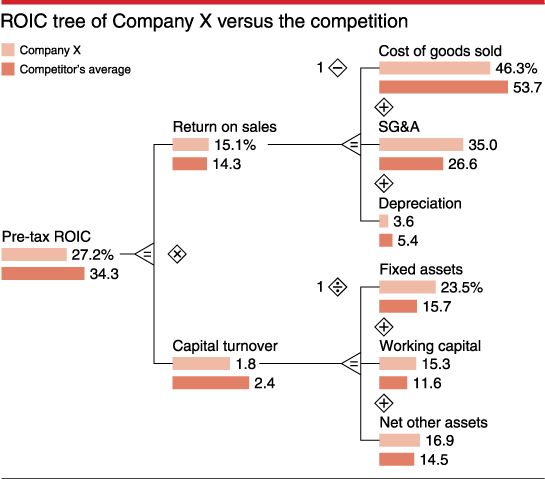

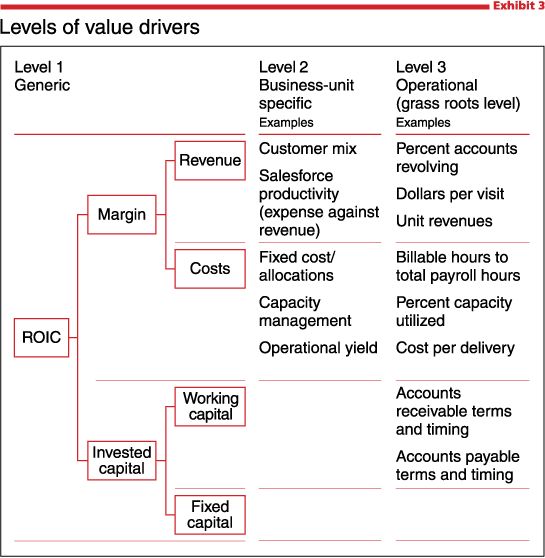

Value drivers must be defined at a level of detail consistent with the decision variables that are directly under the control of line management. Generic value drivers, such as sales growth, operating margins, and capital turns, might apply to most business units, but they lack specificity and cannot be used well at the grass roots level. Exhibit 3 shows that value drivers can be useful at three levels: generic, where operating margins and invested capital are combined to compute ROIC; business unit, where variables such as customer mix are particularly relevant; and grass roots, where value drivers are precisely defined and tied to specific decisions that front-line managers have under their control.

Exhibit 3

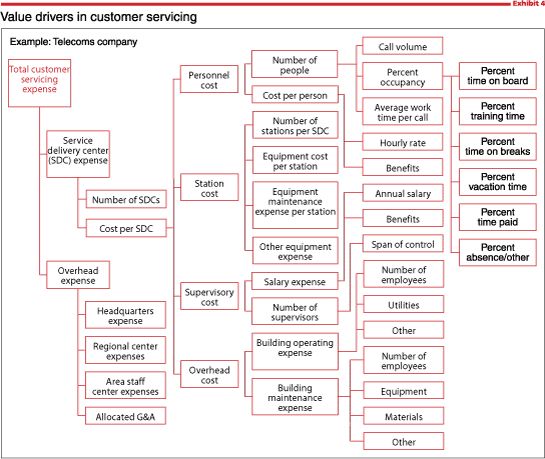

Exhibit 4

What is important is that these key value drivers, although only a small part of the total business system, have a significant impact on value, are measurable from month to month, and are clearly under the control of line management.

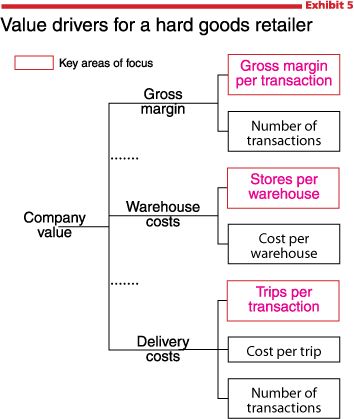

Exhibit 5

Analysis of these variables showed that the number of stores per warehouse significantly affected the cost per transaction: the more stores that could be served by a single warehouse, the lower the warehouse costs relative to revenues. The scale economies were substantial enough to support a strategy of growth through metropolitan concentration, rather than a shot-gun approach of scattering new stores over a wide area. The number of stores per warehouse thus became a strategic value driver.

Further analysis revealed that the number of delivery trips per transaction was very high. Whenever there were errors in an order or goods proved defective, multiple deliveries had to be made to a single customer. The retailer found that it was making an average of 1.5 trips per transaction, compared with a theoretical minimum of 1.0. Management believed this was high for the industry and thought it should be reduced to 1.2. Attaining this performance would increase value by 10 percent. So trips per transaction became an operating value driver as the company began to monitor its monthly performance.

Key value drivers are not static; they must be regularly reviewed. Once the retailer reaches its goal of 1.2 delivery trips per transaction, for example, it may need to shift its focus to cost per trip (while continuing to monitor trips per transaction to make sure it stays on target).

Identifying key value drivers can be difficult because it requires an organization to think about its processes in a different way. Often, too, existing reporting systems are not equipped to supply the necessary information. Mechanical approaches based on available information and purely financial measures rarely succeed. What is needed instead is a creative process involving much trial and error.

Nor can value drivers be considered in isolation from each other. A price increase might, taken alone, boost value—but not if it results in substantial loss of market share. In seeking to understand the interrelationships among value drivers, scenario analysis is a valuable tool. It is a way of assessing the impact of different sets of mutually consistent assumptions on the value of a company or its business units. Typical scenarios include what might happen if there is a price war, or if additional capacity comes on line in another country? Thinking about such issues helps management avoid getting caught off guard and brings to life the relationship between strategy and value.

Management processes

Adopting a value-based mindset and finding the value drivers gets you only halfway home. Managers must also establish processes that bring this mindset to life in the daily activities of the company. Line managers must embrace value-based thinking as an improved way of making decisions. And for VBM to stick, it must eventually involve every decision maker in the company.There are four essential management processes that collectively govern the adoption of VBM. First, a company or business unit develops a strategy to maximize value. Second, it translates this strategy into short- and long-term performance targets defined in terms of the key value drivers. Third, it develops action plans and budgets to define the steps that will be taken over the next year or so to achieve these targets. Finally, it puts performance measurement and incentive systems in place to monitor performance against targets and to encourage employees to meet their goals.

These four processes are linked across the company at the corporate, business-unit, and functional levels. Clearly, strategies and performance targets must be consistent right through the organization if it is to achieve its value creation goals.

Strategy development

Though the strategy development process must always be based on maximizing value, implementation will vary by organizational level.At the corporate level, strategy is primarily about deciding what businesses to be in, how to exploit potential synergies across business units, and how to allocate resources across businesses. In a VBM context, senior management devises a corporate strategy that explicitly maximizes the overall value of the company, including buying and selling business units as appropriate. That strategy should be built on a thorough understanding of business-unit strategies.